Fintech Amount cuts about 18% of workforce

Payments Dive

JUNE 28, 2022

The Chicago-based banking technology provider, valued at $1 billion last year, said this week it had pared 108 workers in what the company called “proactive adjustments.

Payments Dive

JUNE 28, 2022

The Chicago-based banking technology provider, valued at $1 billion last year, said this week it had pared 108 workers in what the company called “proactive adjustments.

ATM Marketplace

JUNE 28, 2022

When it comes to ATM servicing, the same issues tend to pop up again and again. For example, ATMs often get jammed, or the power might drop due to the fact the ATM is sharing a power outlet with many other devices. Fortunately, there are simple solutions to these common issues.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

JUNE 28, 2022

The San Francisco-based provider of credit and payment solutions to small businesses recently announced partnerships with both card network Visa and payment processing platform Stripe.

ABA Community Banking

JUNE 28, 2022

Experiences like Northwest Bank’s are not unprecedented—and sudden death is not the only incident that can rock an organization’s world and trigger the succession plan. The post When it’s time to invoke the succession plan appeared first on ABA Banking Journal.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

Payments Dive

JUNE 28, 2022

With $175 million in recently raised capital, the British new entrant in the U.S. earned wage access arena is setting lofty goals for expansion.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Dive

JUNE 28, 2022

The card offers customers 3% cashback on all purchases at any of the restaurant brands’ 185 locations.

CFPB Monitor

JUNE 28, 2022

The Federal Trade Commission (FTC) recently proposed a rule that would impose a number of new substantive and disclosure requirements on auto-dealers in the car-buying process. The FTC described the proposed Rule as one designed “to ban junk fees and bait-and-switch advertising tactics that can plague consumers throughout the car-buying experience.

Payments Dive

JUNE 28, 2022

The digital payments company is targeting small business owners as they seek credit financing and loans.

William Mills

JUNE 28, 2022

During the NHL Playoffs, sports fans may hear a lot about the Stanley Cup – the trophy given to the winner in the best of seven series. Beyond a three-foot tall tower of metal, the widely recognized hockey trophy symbolizes the leadership, the competitive desire of the team and the long road it took to win such a distinguished prize.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

The Paypers

JUNE 28, 2022

Standard Chartered Bank Saudi Arabia as launched an application programming interface (API) platform to meet the evolving needs of customers, according to Zawya.

BankInovation

JUNE 28, 2022

When it comes to implementing a large-scale automation project, banks have to learn to walk before they can run. But they're under intense pressure to accelerate digital transformation and make it easier than ever for their customers. Financial institutions waste at least $5.9 billion every year due to the poor customer onboarding experience. The new […].

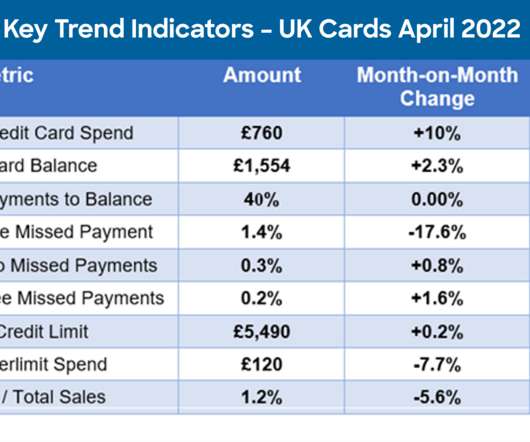

FICO

JUNE 28, 2022

Home. Blog. FICO. UK Credit Card Trends: Cost-of-Living Stress Starts to Show in Data. The signs of the cost-of-living crisis are still limited, with the biggest area of concern being a 3 percent increase in missed payments for new accounts. Darcy Sullivan. Tue, 11/10/2020 - 12:17. by Liz Ruddick. expand_less Back To Top. Tue, 06/28/2022 - 14:10. FICO’s report of April 2022 UK card trends shows some early signs of the impact of the widely reported cost-of-living pressures.

The Paypers

JUNE 28, 2022

Pangea , a supplier of digital identity, security, and e-payment solutions, has launched an artificial intelligence (AI) driven passenger background check system specifically designed for border control agencies.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

Tomorrow's Transactions

JUNE 28, 2022

I had the privilege to chair a discussion about identity in the metaverse at the Identiverse conference in Denver in June 2022, and had great fun discussing the new landscape for identity with Heather Vescent, Jonathan Howle, Katryna Dow and Gopal Padinjaruveetil. In order to frame my thoughts and get the discussion about identity and… Continue reading Identity in the Metaverse.

The Paypers

JUNE 28, 2022

FIRA (Trust Funds for Rural Development) , a Mexico-based second-tier development bank, has partnered with PrimeRevenue , a provider of technology-enabled working capital solutions

The Paypers

JUNE 28, 2022

The Bank of London , a clearing, agency, and transaction bank, has teamed up with SAP Fioneer , a provider of financial services software solutions and platforms, to transform and simplify global clearing and transaction banking.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

The Paypers

JUNE 28, 2022

CanDeal , an operator of Canadian market and infrastructure services, has partnered with five of Canada's largest domestic banks to deliver a Know Your Client (KYC) solution to the Capital Markets Industry.

The Paypers

JUNE 28, 2022

Binance has partnered with Latam Gateway amid the suspension of direct fiat deposits and withdrawals in Brazil.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

Bank Activities

JUNE 28, 2022

By Zoran Temelkov June, 2022. Allice Bank has experienced a lending growth to more than £500 million, while deposits grew to more than £800 million during the first two years of its operations. It anticipates it will achieve £3 billion in lending to established SMEs in the upcoming years. In its latest round, Allica Bank secured a total of £55 million in debt and equity funding.

The Paypers

JUNE 28, 2022

Kredinor , a Norway-based provider of debt management services, has selected Neonomics to deliver more efficient payments and financial data services through Open Banking.

The Paypers

JUNE 28, 2022

Global modern card issuing platform Marqeta has expanded its credit platform by adding a new, intuitive dashboard and more than 40 credit APIs that will further help customers.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Let's personalize your content