How Amazon will Likely Influence Your B2B Marketplace Strategy

Perficient

FEBRUARY 8, 2021

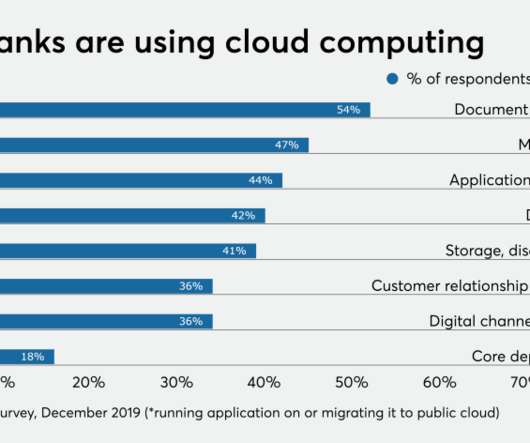

Amazon is one of the largest marketplaces that we as consumers have ever seen. With that, Amazon has primarily focused on a direct to consumer structure and caters more to end-user customers vs. the traditional B2B channel; that is, until a few years ago when the ecommerce titan really put some weight behind its B2B strategy– and boy has it made some waves.

Let's personalize your content