If you’re API and you know it, block aggregators

Chris Skinner

FEBRUARY 18, 2020

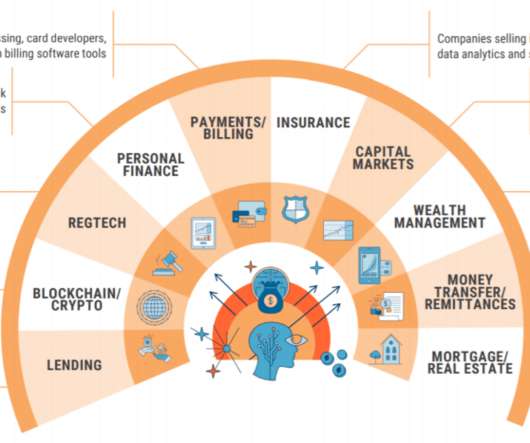

I bumped into a real API marketplace the other day. Just what I’ve been looking for … … but not sure why they’re opening physical stores pic.twitter.com/NaUUiyQ4lK — Chris Skinner (@Chris_Skinner) February 17, 2020 It gained a few nice comments like: “So people could stock up on spaghetti code and … The post If you’re API and you know it, block aggregators appeared first on Chris Skinner's blog.

Let's personalize your content