Balancing payment innovation and trust

Payments Dive

NOVEMBER 22, 2019

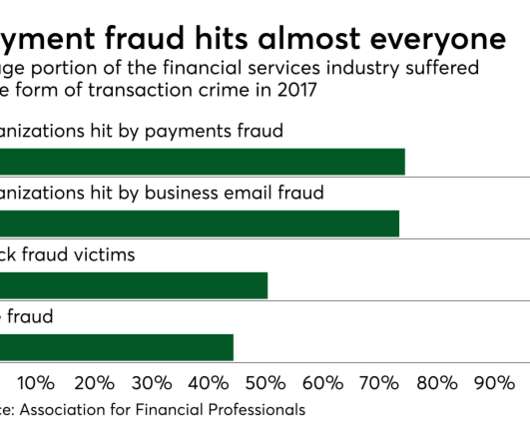

The rise of digital payments has led to a series of complex issues surrounding how to make those transactions more secure. Rapid innovation in the global payments space has created new opportunties for bad actors to expoit these new ecosystems and requires ways of thinking on how to approach the subject.

Let's personalize your content