The future of the Euro (#coronavirus bonds)

Chris Skinner

APRIL 20, 2020

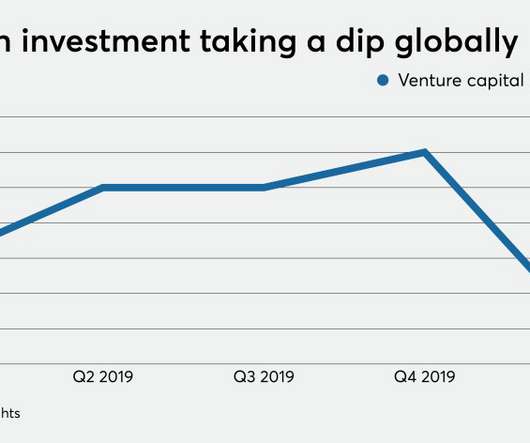

For most of my adult life, we’ve been part of the European Union. The Brexit vote came as a shock, and the unravelling of Britain from Europe for the past four years has been a major stalemate in British life and politics. Now, the whole euro project might come tumbling … The post The future of the Euro (#coronavirus bonds) appeared first on Chris Skinner's blog.

Let's personalize your content