It’s a start-up world

Chris Skinner

JANUARY 23, 2020

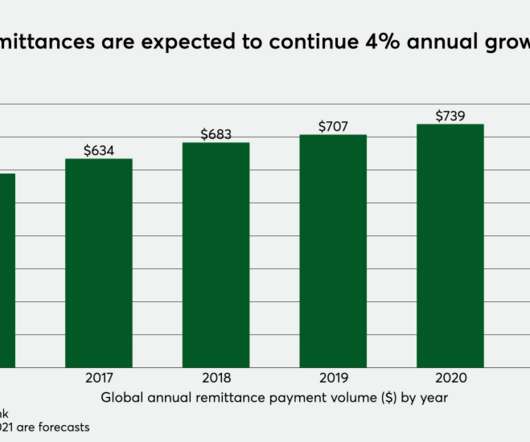

Although most businesses fail in their first year, it is quite incredible just how many start-ups there are around the world doing something interesting with technology. According to Embroker: In 2016, 69% of U.S. entrepreneurs started their business at home. In 2018, there were 145 “active unicorns” in the U.S. collectively … The post It’s a start-up world appeared first on Chris Skinner's blog.

Let's personalize your content