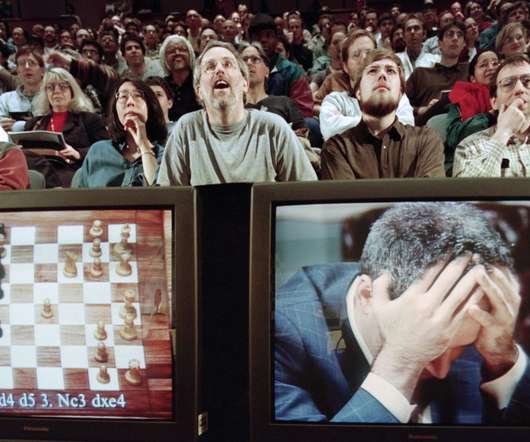

“I was the first knowledge worker whose job was threatened by a machine”

Chris Skinner

FEBRUARY 27, 2020

Really interesting interview with Garry Kasparov in Wired magazine about the potential of artificial intelligence (AI) in the future. Garry Kasparov is perhaps the greatest chess player in history. For almost two decades after becoming world champion in 1985, he dominated the game. Then, in 1997, at the height of … The post “I was the first knowledge worker whose job was threatened by a machine” appeared first on Chris Skinner's blog.

Let's personalize your content