Where Goldman, Citi, JPMorgan are putting fintech investment dollars

(Full story

CFPB poised to reinstate tough stance on payday lenders

(Full story

Refi slowdown means no more 'lazy mode' for mortgage lenders

(Full story

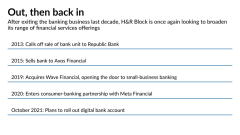

H&R Block entering crowded field of challenger banks

(Full story

Two bankers banned from industry in closely watched trade secret case

(Full story

Will Senate vote on CFPB chief come down to tiebreaker?

(Full story

Edinburg Teachers Credit Union placed into conservatorship

(Full story

Former Partners FCU chief to lead new technology CUSO

(Full story

Calls intensify for Congress to intervene on Libor

(Full story

Banks added jobs in 2020. Are layoffs ahead?

(Full story