Black Friday sets online, mobile shopping records

Payments Dive

DECEMBER 2, 2019

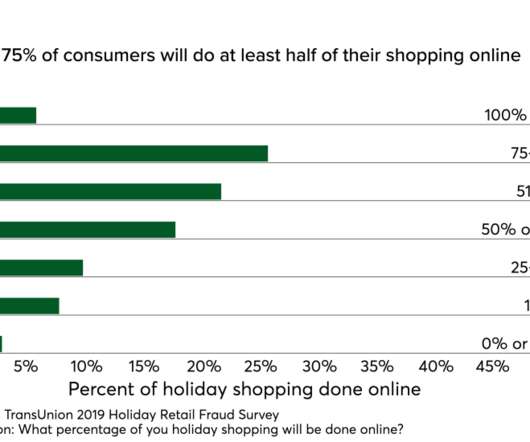

Black Friday shopping figures in the U.S. showed more consumers embracing mobile and general online shopping for the best deals. Meanwhile average order volume increased, showing more willingness to make big ticket purchases via smartphone.

Let's personalize your content