The personalities driving today’s banking consumers

Accenture

MARCH 30, 2021

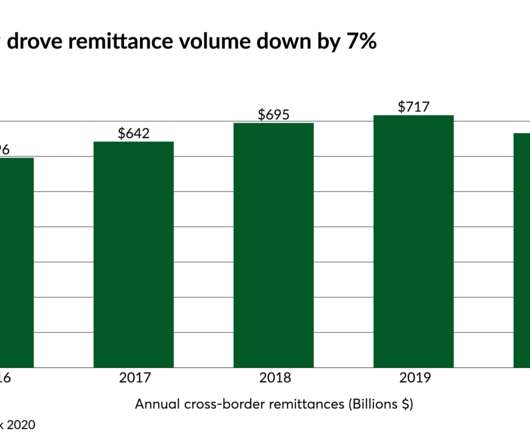

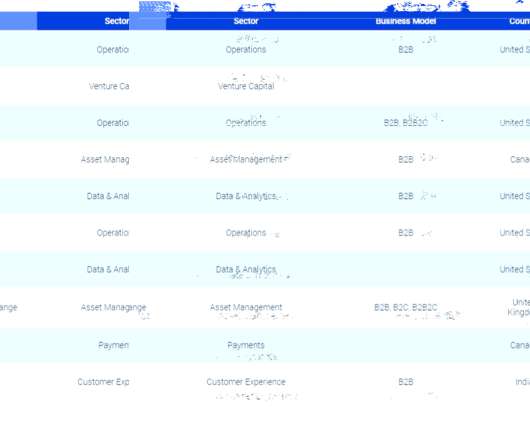

The COVID-19 pandemic has driven a rapid uptake of digital banking around the world. The incredible speed of the adoption has rewritten some of the fundamentals of the industry, including how consumers behave and what they expect from banks in 2021. Our latest Global Banking Consumer Study, drawing on input from more than 47,000 consumers…. The post The personalities driving today’s banking consumers appeared first on Accenture Banking Blog.

Let's personalize your content