Payoneer tees up Webster Bank exec for CFO

Payments Dive

JANUARY 19, 2023

Webster Bank alum Bea Ordonez will take the payments company’s finance reins in March after current CFO Michael Levine steps away from the role.

Payments Dive

JANUARY 19, 2023

Webster Bank alum Bea Ordonez will take the payments company’s finance reins in March after current CFO Michael Levine steps away from the role.

CFPB Monitor

JANUARY 19, 2023

The eyes of the consumer finance world are now on the Supreme Court as it decides whether to grant the CFPB’s certiorari petition in Consumer Financial Services Association Ltd. v. CFPB. In the decision, a Fifth Circuit panel held the CFPB’s funding mechanism violates the Appropriations Clause of the U.S.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

JANUARY 19, 2023

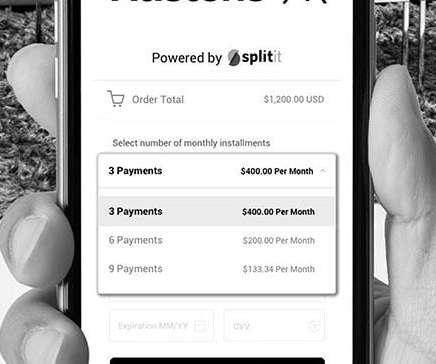

Splitit isn’t interested in being acquired, but the BNPL provider believes there may be assets ripe for the picking amid consolidation.

TheGuardian

JANUARY 19, 2023

Data shows UK banks losing well-paid staff, as Italy, France and Spain make up 70% of rise in EU top earners A record 1,957 bankers across Europe earned more than €1m (£878,000) last year, according to data that shows the scale at which some of the best-paid jobs in Britain have moved from London to the EU since Brexit. The European Banking Authority disclosed on Thursday that the number of bankers earning €1m or more a year had increased by more than 40%, from 1,383 in 2020 to 1,957 in 2021.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

Payments Dive

JANUARY 19, 2023

Although many companies are pulling back spending amid the darker economic climate, new CEO Sunil Rajasekar said the B2B payments firm is not.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

BankUnderground

JANUARY 19, 2023

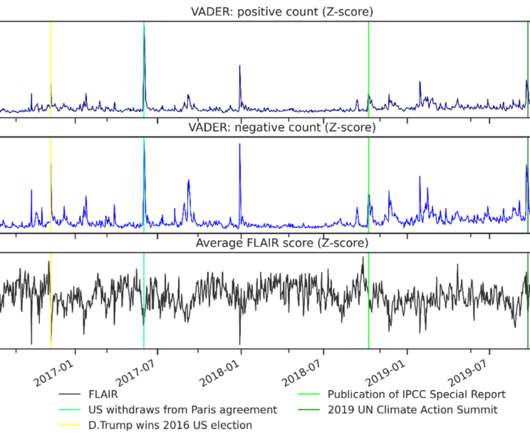

Gerardo Martinez In 1936, John Maynard Keynes coined the famous term ‘Animal Spirits’ to illustrate how people take decisions based on urges, overlooking the benefits and drawbacks of their actions. To what extent are prices of Environmental, Social and Governance (ESG) assets driven by the sentiment of market participants, as opposed to economic fundamentals?

CFPB Monitor

JANUARY 19, 2023

In Circular 26-23-03 the U.S. Department of Veterans Affairs (VA) announced the elimination of the HUD/VA Addendum to Uniform Residential Loan Application (VA Form 26-1802a), as well as the Federal Collection Policy Notice (VA Form 26-0503). The VA advises in the Circular that it has consolidated those forms into VA Form 26-1820 , which is used by lenders to report a loan to VA for guaranty upon closing.

The Paypers

JANUARY 19, 2023

The National Australia Bank (NAB) has become the second Australian bank to create a stablecoin by launching AUDN on the Ethereum and Algorand blockchain.

CB Insights

JANUARY 19, 2023

Square provides commerce solutions and business software for millions of brands and small businesses. In December 2021, Square changed its corporate name to Block , separating the corporate entity from its subsidiary businesses that it calls its “building blocks.” Those include Square, Cash App , Spiral , Tidal , and TBD. Over the last 2 years, Block’s expansion activity through acquisitions, investments, and partnerships point to 2 clear goals for the evolution of the company

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

BankInovation

JANUARY 19, 2023

Fifth Third Bank saw higher technology-related expenses during the fourth quarter as it continued to invest in “platform modernization,” including the launch of its new cloud-based mobile app, Chief Financial Officer Jamie Leonard said during today’s earnings call.

PopularBank

JANUARY 19, 2023

A New York City organization that empowers women to succeed professionally Established in 1999, Bottomless Closet is one of the organizations that Popular Foundation supports through employee contribution-based grants. The organization’s goal is to support women as they enter or return to the workforce. Since its founding, Bottomless Closet has helped nearly 50,000 NYC women.

BankInovation

JANUARY 19, 2023

Capital One Financial Corp. eliminated hundreds of technology positions this week, the result of the credit-card giant spending years investing in systems meant to improve its efficiency. More than 1,100 workers were affected, according to a person familiar with the matter who asked not to be identified discussing a private matter.

FICO

JANUARY 19, 2023

Home Blog FICO Risk and Lending Predictions 2023: Hyper-Personalisation and More Hyper-personalizing customer treatments, understanding borrowers' financial resilience and scenario simulation and testing will all be priorities for financial services FICO Admin Thu, 12/19/2019 - 16:29 by Doug Craddock Senior Principal Consultant expand_less Back To Top Thu, 01/19/2023 - 12:15 During the past two years the industry has seen a series of once-in-a-generation events take place with the global pandemi

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

BankInovation

JANUARY 19, 2023

JPMorgan Chase & Co. and International Finance Corp. are leading a $27 million round of investment in KLYM, a data-driven fintech that focuses on providing working capital to small and midsize companies in Latin America.

The Paypers

JANUARY 19, 2023

US-based fraud prevention company, Signifyd , has recently announced the launch of its State of Fraud 2023 report in which is tackles the most important fraud trends to look after this year.

BankInovation

JANUARY 19, 2023

Truist Financial increased its non-interest expenses in the fourth quarter of 2022 as minimum wage increased and the bank invested in technology, acquisitions, revenue-generating business and call center staff. The $548 billion bank’s adjusted non-interest expenses grew 8% year over year to $3.4 billion, according to its Q4 earnings presentation.

The Paypers

JANUARY 19, 2023

Research from the CBI and Finastra has showed that there is a gap between the ambition of firms to trade internationally and the reality of doing so.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

American Banker

JANUARY 19, 2023

The Paypers

JANUARY 19, 2023

Austria-based crowdfunding platform Invesdor has announced becoming the first platform in the DACH region to receive the European Crowdfunding Service Providers (ECSP) licence.

American Banker

JANUARY 19, 2023

The Paypers

JANUARY 19, 2023

US-based modern card issuing platform, Marqeta , has announced the launch of a new web push provisioning product that sets to expand the company’s payment card tokenization capabilities.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

The Paypers

JANUARY 19, 2023

Hong-Kong-based lifestyle-driven virtual bank livi bank has launched livi QR Payment, an UnionPay option that enables customers to pay at over 29 million merchants in mainland China.

The Paypers

JANUARY 19, 2023

UK-based cross-border payments platform Currencycloud has team up with capital platform Vauban to make latter’s VC platform more accessible to global investors.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Let's personalize your content