Fiserv scoops up Nextable

Payments Dive

NOVEMBER 3, 2022

With the latest acquisition, Fiserv is further strengthening its restaurant chops, adding cloud-based reservation and table management to its BentoBox operation.

Payments Dive

NOVEMBER 3, 2022

With the latest acquisition, Fiserv is further strengthening its restaurant chops, adding cloud-based reservation and table management to its BentoBox operation.

Accenture

NOVEMBER 3, 2022

A recent Accenture survey found that embedded finance offerings to small and medium-sized enterprises could increase global bank revenues by as much as US$92 billion by 2025. Embedded finance offers banks a huge opportunity to grow their businesses. I’ve asked my colleague Chris Jaggard to share his insights into this opportunity. Chris is the Commercial….

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

NOVEMBER 3, 2022

The payments company will cut about 1,140 jobs as it reins in expenses in the face of deteriorating economic conditions after growing too fast.

SWBC's LenderHub

NOVEMBER 3, 2022

Your borrowers expect a wide range of valuable services that are timely and relevant in today's economy. For example, Guaranteed Asset Protection (GAP) coverage gives them a safety net if their vehicles are ever totaled or stolen and not recovered—helping cover the difference between the insurance company settlement and the balance of the loan. Vehicle purchases have always been huge decisions, but with the price of vehicles and interest rates on the rise, your borrowers need to protect their ve

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

Payments Dive

NOVEMBER 3, 2022

Twitter’s new billionaire owner plans to make the company into a payments player, but industry pros say social media platforms aren’t cut out for that game.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Dive

NOVEMBER 3, 2022

As it pursues more fintech clients, the payments processor sees B2B and commercial cards as areas ripe for expansion.

CFPB Monitor

NOVEMBER 3, 2022

The U.S. Department of Education recently announced final regulations , effective July 1, 2023, designed to expand and improve the major student loan discharge programs authorized by the Higher Education Act. Among other things, the final regulations prohibit institutions that participate in the Federal Direct Loan program from requiring borrowers to sign mandatory pre-dispute arbitration agreements or class-action waivers that would be applicable to disputes about Direct Loans.

CB Insights

NOVEMBER 3, 2022

While insurtech funding has remained relatively flat quarter-over-quarter in 2022, insurers are still actively engaging with startups to improve their businesses — including addressing climate-related risks. . download the State of Fintech Q3 ’22 Report. Get the free report for analysis on dealmaking, funding, and exits by private market fintech companies.

The Paypers

NOVEMBER 3, 2022

Twilio has announced the update of their Customer Engagement Platform with capabilities for strengthening digital businesses’ customer relationships.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

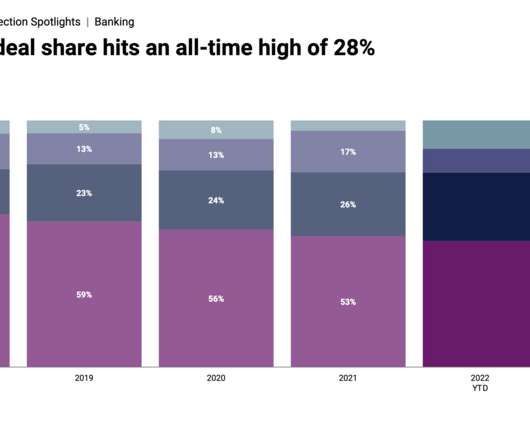

CB Insights

NOVEMBER 3, 2022

Fintech funding stumbled in Q3’22 , falling 38% quarter-over-quarter to $12.9B. Banking startups were also hit hard, with dollars invested falling to the lowest level since 2018. But even with financing becoming tighter, technologies are still emerging that could shake up the industry. download the State of Fintech Q3 ’22 Report. Get the free report for analysis on dealmaking, funding, and exits by private market fintech companies.

The Paypers

NOVEMBER 3, 2022

The Paypers has launched the 6th edition of the Open Banking Report , which uncovers the global potential of Open Banking, Open Finance, and Open Data.

Bussman Advisory

NOVEMBER 3, 2022

FinTech Ecosystem Insights by Bussmann Advisory is our weekly newsletter with over 47’000 subscribers across different social media channels, summarizing relevant news and reports related to ecosystems around disruptive technologies, highlighting key updates from the industry as well as our portfolio companies: Elon Musk begins mass layoffs at Twitter.

BankInovation

NOVEMBER 3, 2022

Core provider FIS saw a slight increase in banking solutions revenue in the third quarter as demand for its technology offerings remained strong amid economic uncertainty. The fintech reported $1.6 billion in banking solutions revenue, up 4% year over year and 23% sequentially. Total revenue clocked in at $3.6 billion, a 3% YoY increase, according […].

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

FICO

NOVEMBER 3, 2022

Home. Blog. FICO. Debt Collection: Have We Learned the Lessons of the Last Crises? While the current series of economic shocks may seem "unprecedented", there are clear lessons from past crises that should shape our collections strategies today. FICO Admin. Tue, 07/02/2019 - 02:45. by Bruce Curry. Senior Principal Consultant. expand_less Back To Top.

BankInovation

NOVEMBER 3, 2022

Stripe Inc., one of the world’s most valuable startups, will cut more than 1,000 jobs as it seeks to rein in costs ahead of any economic downturn. The payments company will cut its workforce by 14% this week, returning headcount to the almost 7,000 total from February, co-founders Patrick and John Collison said in an […].

CB Insights

NOVEMBER 3, 2022

Insurtech funding dipped by just 4% quarter-over-quarter (QoQ) in Q3’22 to hit $2.3B ? — the lowest it’s been since Q2’20. Deals also fell slightly, down 2% QoQ to reach 140. . Funding was primarily driven by P&C insurtech startups, which grabbed $1.8B across 89 deals — representing over 75% of all insurtech funding in Q3’22.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

The Paypers

NOVEMBER 3, 2022

Payment orchestration platform BlueSnap and ecommerce agency objectsource to include four new payment methods including ApplePay, Google Pay, iDeal, and Sofort in their Magento integration.

American Banker

NOVEMBER 3, 2022

The Paypers

NOVEMBER 3, 2022

The Bank of Canada has urged firms to prepare for a regulatory regime that will cover companies providing services like digital wallets and electronic payment systems.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

The Paypers

NOVEMBER 3, 2022

UK-based challenger bank Tandem has launched its new Tandem Marketplace, a consumer-focused hub which provides information and resources to promote greener living.

The Paypers

NOVEMBER 3, 2022

China-based Ant Group has launched Alipay+ D-store , a business digitalisation solution aimed at helping the service industry digitalise their operations.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Let's personalize your content