Healthcare fintechs targeted by cyber criminals

Payments Dive

SEPTEMBER 8, 2022

Cybersecurity professionals say healthcare payments processing firms are particularly vulnerable to information technology breaches and ransom demands.

Payments Dive

SEPTEMBER 8, 2022

Cybersecurity professionals say healthcare payments processing firms are particularly vulnerable to information technology breaches and ransom demands.

Accenture

SEPTEMBER 8, 2022

Getting young graduates excited about working in commercial banking will be a challenge for incumbents, as our report on Commercial Banking Top Trends in 2022 highlights. I began this series with a look at the industry’s outdated image in Wall St to Elm St: Surviving the talent nightmare. Then, in Smart banks will value talent…. The post How can banks embrace a growing Gen Z workforce?

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

SEPTEMBER 8, 2022

At least a dozen U.S. cities have implemented unconditional direct cash payment programs over the past year, as advocates seek to build evidence and experts debate the most effective structures.

Accenture

SEPTEMBER 8, 2022

The $369 billion “climate action bill” that the US has just passed into law is positive news for banks committed to combatting climate change and advancing sustainability. The new legislation is likely to prompt corporate customers of US banks to accelerate their efforts to reduce greenhouse gas emissions to net zero. Such moves would be…. The post Banks set to deliver on $369 billion climate act appeared first on Accenture Banking Blog.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

Payments Dive

SEPTEMBER 8, 2022

The payments company hopes to gain more business-to-business payments market share as the demand for expense management services rises.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Dive

SEPTEMBER 8, 2022

Here are 10 takeaways from the Fed's new head of supervision, on everything from payments to crypto to FedNow.

Bobsguide

SEPTEMBER 8, 2022

MX.3 clients benefit from international venue data access that covers broad asset class range. LONDON and PARIS, September 8, 2022 —Murex, the global leader in trading, risk management and processing solutions for capital markets, has integrated with ICE Data Services, which is part of Intercontinental Exchange (NYSE:ICE), to offer a more efficient workflow for accessing ICE’s fixed income and derivatives data via the MX.3 platform.

BankUnderground

SEPTEMBER 8, 2022

Giovanni Covi, James Brookes and Charumathi Raja. How banks are exposed to the financial system and real-economy determines concentration risk and interconnectedness in the banking sector, and in turn, the severity of tail-events. We construct the Global Network data set , a comprehensive exposure-based data set of the UK banking sector, updated quarterly, covering roughly 90% of total assets.

Bobsguide

SEPTEMBER 8, 2022

Private Market Hub Becomes the First Multi-jurisdictional, Multi-tenant Enabled Solution for Private Equity Firms Globally; Northern Trust funds first to go live on the new multi-jurisdictional environment. Leveraging blockchain technology to alleviate the complexities faced by asset managers with funds in multiple geographies, global Fintech leader, Broadridge Financial Solutions, has released a multi-jurisdictional version of its private equity platform, Private Market Hub, now available to fu

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

CFPB Monitor

SEPTEMBER 8, 2022

Our discussion examines the FTC’s Advanced Notice of Proposed Rulemaking relating to what it describes as “commercial surveillance” and the CFPB’s circular confirming that covered persons and service providers may violate the Consumer Financial Protection Act’s prohibition against unfair acts or practices when they fail to adequately safeguard consumer information.

ABA Community Banking

SEPTEMBER 8, 2022

The latest incarnation of ABA's award-winning #BanksNeverAskThat anti-phishing campaign returns in October. The season premiere of the ABA Banking Journal Podcast features a banker's perspective on participating in the campaign and a sneak preview of new creative. The post Podcast: How #BanksNeverAskThat helps protect bank clients against fraud appeared first on ABA Banking Journal.

CFPB Monitor

SEPTEMBER 8, 2022

On September 6, 2022, Curinos published an update to their “ Competition Drives Overdraft Disruption” study published in December 2021. Curinos was formed from the combination of two data driven business intelligence companies, Novantas and Informa’s FBX business. . As has been previously reported by the CFPB through a blog post and two December 2021 overdraft reports , which we previously blogged about here and here , many banks have announced innovations and policy changes in the past yea

BankInovation

SEPTEMBER 8, 2022

JPMorgan Chase recently launched its data analytics-based Customer Insights platform in order to provide its small business clients with a deeper understanding of their customer base through their transaction and payment history. “How do you let a machine learn the data and then translate it to a business recommendation?” Tony Wimmer, managing director and head […].

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

CFPB Monitor

SEPTEMBER 8, 2022

The August 31 closing of the California legislative session likely marked the end of hopes for an extension of the limited exemptions for employee and business-to-business (B2B) data that have existed for the California Consumer Privacy Act (“CCPA”) since its inception. As a result, when the the California Privacy Rights Act (CPRA) goes into effect on January 1, 2023, employee and B2B data will be treated the same as consumer data. .

BankInovation

SEPTEMBER 8, 2022

(Bloomberg) -- Goldman Sachs Group Inc. provided a $140 million credit line to help finance a Mexico expansion for Latin American fintech Xepelin Holdings Inc., which offers services including payments and credit to small and midsize companies that do business with other firms. “It’s our largest credit facility so far, denominated in Mexican pesos, and […].

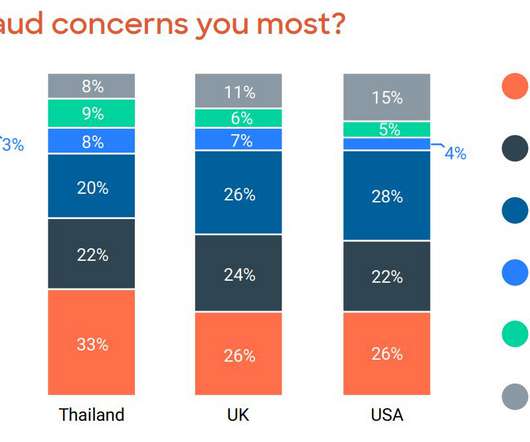

FICO

SEPTEMBER 8, 2022

Home. Blog. FICO. Payments Fraud in Asia Post Pandemic. Why consumers are moving to banks with the best fraud and scam prevention. Saxon Shirley. Thu, 06/17/2021 - 06:40. by CK Leo. Senior Consultant, Fraud and Financial Crime. expand_less Back To Top. Thu, 09/08/2022 - 01:00. The growth of real-time payments and fraud in Asia. The payments landscape in Asia is rapidly evolving, thanks to the emergence of new payment methods.

BankInovation

SEPTEMBER 8, 2022

Robotic process automation (RPA) giant UiPath is taking a hit on Wall Street despite its recent acquisition of Re:infer, a natural language processing (NLP) company. The company’s stock has fallen 14% over the past 5 days, and 37% in the last month. For comparison, one year ago on Sept. 8, 2021, the company’s stock price […].

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

The Paypers

SEPTEMBER 8, 2022

Germany-based online loan provider iwoca has partnered with eBay to launch the financing solution eBay Flexi-Kapital.

BankInovation

SEPTEMBER 8, 2022

We’ve all heard the term user experience (UX) a lot in recent years, but what does UX actually mean for financial institutions and their digital payments platforms? In this article, we’ll let you know why UX design should be a vital part of your digital strategy. We’ll also discuss the top three factors that can make […].

The Paypers

SEPTEMBER 8, 2022

US-based financial services company Goldman Sachs has agreed to lend USD 140 million to Chile-based fintech Xepelin to support its expansion into Mexico.

The Banker

SEPTEMBER 8, 2022

There are rising concerns over China’s banking system as the country’s lenders feel the effects of slowing growth combined with a deflating real estate market. Justin Pugsley reports.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

The Paypers

SEPTEMBER 8, 2022

France-based credit decisioning platform Algoan has targeted the UK with its API-centred Payment Scoring that assesses a consumer’s ability to make loan payments.

The Banker

SEPTEMBER 8, 2022

As climate change threatens increased risk of floods, banks and insurers have a responsibility to galvanise their insurance policies. Philippa Nuttall reports.

The Paypers

SEPTEMBER 8, 2022

UK-based digital commerce platform VTEX has partnered with fintech Adyen to accelerate bands and retailer’s growth with unified ecommerce across all touchpoints.

Image Works Direct

SEPTEMBER 8, 2022

Digital marketing might sometimes feel like one more thing you need to be on top of as a marketer. But there are some major advantages to digital marketing.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Let's personalize your content