Preparing For the 7 Waves From The Fed Hike

South State Correspondent

JUNE 21, 2022

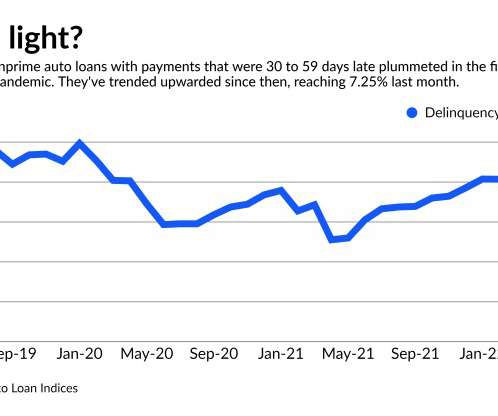

Last week the Federal Reserve hiked interest rates by 75 basis points – its most significant hike since 1994. This decision coincided with rate hikes by the Swiss National Bank, its first since 2007, the Bank of England, and the European Central Bank announced at an emergency meeting that they would raise interest rates next month and again in September.

Let's personalize your content