MoneyGram dives deeper into crypto

Payments Dive

NOVEMBER 2, 2022

The money transfer company said it’s adding a new crypto feature to its mobile app, expanding on an attempt to appeal to a younger client set.

Payments Dive

NOVEMBER 2, 2022

The money transfer company said it’s adding a new crypto feature to its mobile app, expanding on an attempt to appeal to a younger client set.

Accenture

NOVEMBER 2, 2022

The payments industry has undergone unprecedented transformation in recent times given the global pandemic, geopolitical shifts, recalibration of supply chains, accelerating digitalization and significant economic turbulence. The fascinating conversations around payments at the recent Sibos conference highlighted just how fast things are changing. The conference was attended to the same level as pre-pandemic and some….

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

NOVEMBER 2, 2022

Recent reports from Ernst & Young, Forrester Research and McKinsey examined forces at play in the payments industry, from “swipe” fee frustration to open banking and cross-border payments trends.

Accenture

NOVEMBER 2, 2022

In the wake of the Sibos conference, it looks to me like banking right now is full of paradoxes. Central bank digital currencies (CBDCs) are a total game changer or a complete dud. Fintechs are an existential threat to incumbent banks or they are their most important partners. Sustainability is on the cusp of major…. The post Four big ideas in the wake of Sibos 2022 appeared first on Accenture Banking Blog.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

Payments Dive

NOVEMBER 2, 2022

Sellers on the company’s online marketplace can access from $500 to $10 million in cash advances, with repayment based on a fixed percentage of their gross merchandise sales.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

South State Correspondent

NOVEMBER 2, 2022

This week the FOMC increased the Fed Funds rate by 75 bps, as expected to the 3.75% to 4.00% target range. The Effective Fed Funds rate jumped up and should stabilize at 3.83%, as did the 1-month term SOFR, to 3.79%. The futures market now expects close to average odds of a 75bps increase in Fed Funds rate for the next FOMC meeting on December 14 th ( HERE ) and about 60% odds of a 75bps hike by January.

Accenture

NOVEMBER 2, 2022

I asked my colleague Danelle Faust—who leads our financial services business within Accenture Song across the Midwest—to be my co-author again. She’s the perfect person to help explore what middle market banks need to do to respond to the most complex consumer behaviors we’ve seen in years. Middle market banks take pride in truly knowing…. The post How banks can make customer relationships even better appeared first on Accenture Banking Blog.

Abrigo

NOVEMBER 2, 2022

3 features that can improve speed and efficiency Construction loan automation eliminates manual processes, saving time and reducing human error. Here's what to look for in a software. You might also like this whitepaper: "10 ways construction loan monitoring software saves time." DOWNLOAD . Takeaway 1 Technology can help reduce or eliminate common problems that construction lenders face during the complicated draw process.

Jack Henry

NOVEMBER 2, 2022

A beloved coworker, long-time Jack Henry blogger , and veteran lender once shared a story that I’ll never forget. Many years ago, he met with a business owner to discuss his cash flow challenges and was considering a revolving line of credit. When asked what he would do with the extra cash, the business owner said, “I would use it to catch up on trade payables and increase my cash position, but the first thing I would do is buy myself two brand-new pairs of shoes.”.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

BankUnderground

NOVEMBER 2, 2022

Rachel Adeney and Amy Fraser. Operational risk is rapidly becoming one of the most important threats to the financial system but is also one of the least well understood. Cyber attacks are regularly cited as one of the top risks faced by firms in the financial sector and one of the most challenging to manage. But they are only one part of operational risk, which includes losses from any kind of business disruption or human error, including power outages or natural disasters.

The Paypers

NOVEMBER 2, 2022

Standard Chartered has announced on the first day of Singapore Fintech Festival the launch of Payouts-as-a-Service (PaaS), a bank-grade fintech solution that allows digital businesses to manage one-to-many payments to parties in their ecosystem.

BankInovation

NOVEMBER 2, 2022

Financial technology provider Kasasa is partnering with 50 community banks around the U.S. on Finder, a new tool that allows banking customers to search by zip code to find local financial institutions (FIs) that offer Kasasa rewards accounts. Finder runs on data input from FIs via Salesforce. Partnering banks including German Valley, Ill.-based, $230 million […].

The Paypers

NOVEMBER 2, 2022

PayMate has incorporated and registered its entities in Singapore and Sri Lanka to offer its B2B payments platform, to help customers’ working capital needs.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

BankInovation

NOVEMBER 2, 2022

The Bank Automation Summit U.S. 2023 agenda is live, with panels and presentations focusing on cloud modernization, strategies for addressing legacy core systems and ideation in banking. The event will also include networking opportunities and roundtable discussions on key technology trends in the U.S. financial services market. Bank Automation Summit U.S. 2023 will take place […].

FICO

NOVEMBER 2, 2022

Home. Blog. FICO. The Rise of Telco Cloud-Based Platform Solutions. As telcos make the transition from on-premises to cloud-based platform solutions, they need to get maximum value from the data sets, information sources and insights available. FICO Admin. Tue, 07/02/2019 - 02:45. by Tim Young. expand_less Back To Top. Wed, 11/02/2022 - 13:35. Many prevailing industry operating models are one to two generations behind the current available telco cloud-based technology.

BankInovation

NOVEMBER 2, 2022

Financial technology provider Kasasa is partnering with 50 community banks around the U.S. on Finder, a new tool that allows banking customers to search by zip code to find local financial institutions (FIs) that offer Kasasa rewards accounts. Finder runs on data input from FIs via Salesforce. Partnering banks including German Valley, Ill.-based, $230 million […].

The Paypers

NOVEMBER 2, 2022

Lean Technologies , an Open Banking platform, has onboarded Wally , a personal finance management platform, after receiving permits from Saudi Central Bank.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

BankInovation

NOVEMBER 2, 2022

E-bill platform Citi Present and Pay has integrated with digital payment service Spring by Citi to create an electronic bill presentment and digital payment acceptance capability for Citi’s institutional clients. The solution allows Citi customers to provide digital billing and collect payments through one technical integration, according to a release.

Image Works Direct

NOVEMBER 2, 2022

About 15 years ago, Pam Palotas of Tendto Credit Union chose to partner with image.works for the Credit Union’s marketing needs. As Pam puts it, “it’s one of the best decisions I’ve ever made.” As the Vice President of Brand Marketing for Tendto, Pam was looking for a way to fulfill their marketing needs on time, within budget and in a creative way.

The Paypers

NOVEMBER 2, 2022

Australia-based payment service provider Live Payments has launched its Tap to Phone contactless payment product LiveTap to boost contactless payment acceptance in Australia.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

The Paypers

NOVEMBER 2, 2022

US-based digital identity platform Socure has partnered with Carahsoft to give government agencies access to Socure’s ID+ platform, an identity verification solution.

The Paypers

NOVEMBER 2, 2022

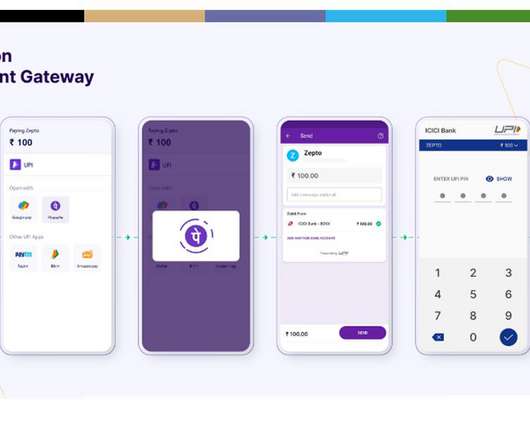

India-based payments and API banking solution Cashfree Payments has enabled food delivery company Zepto with an augmented checkout experience using its payment gateway.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Let's personalize your content