Global Payments to replace CEO

Payments Dive

MAY 1, 2023

CEO Jeff Sloan will step down June 1 and be replaced by the payment processor’s president and chief operating officer, Cameron Bready.

Payments Dive

MAY 1, 2023

CEO Jeff Sloan will step down June 1 and be replaced by the payment processor’s president and chief operating officer, Cameron Bready.

Perficient

MAY 1, 2023

Perficient is proud to sponsor the upcoming North American Financial Information Summit (NAFIS), taking place on May 16th, 2023. NAFIS is the largest North American data conference for banks and asset managers looking to the future of data in financial services. Registration is FREE if you work for a bank, asset manager, financial investor, fund manager or financial institution; click here to receive your free ticket to NAFIS.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

MAY 1, 2023

The giant retailers eagerly await instant payment system possibilities, especially as an alternative to card payments, according to industry professionals who heard their representatives speak recently.

Abrigo

MAY 1, 2023

The importance of mental health in the AML/CFT field The AML/CFT profession can take a toll on mental health due to the responsibilities given to analysts and officers. Here are signs to look for and ways to destress. You might also like this upcoming webinar, "BSA officer’s mindset: A comprehensive look at your AML/CFT program." register now Takeaway 1 The AML/CFT field can be stressful, and it's easy for staff to ignore signs that their mental health is suffering.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

Payments Dive

MAY 1, 2023

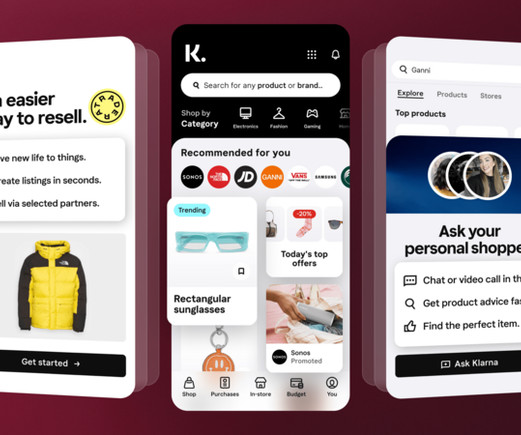

The buy now, pay later company has rolled out an AI-powered shopping feed, along with tools for creators, a personal shopping assistant and new resell capabilities.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

TheGuardian

MAY 1, 2023

US banking titan to buy ‘all deposits and substantially all assets’ of failed bank in deal brokered by regulators JP Morgan is to acquire most of the failed California bank First Republic, in a takeover brokered by regulators as the US races to contain a series of banking failures that has echoes of the 2008 global financial crisis. After weekend talks to prevent a further escalation of the US banking crisis, the Federal Deposit Insurance Corporation (FDIC) confirmed that First Republic had coll

CFPB Monitor

MAY 1, 2023

On April 17, the NYDFS announced the adoption of final regulations intended to shift the cost of supervision and examination of BitLicensees from the NYDFS via the implementation of direct assessments to licensees. The new regulations will primarily only apply to those entities who hold a BitLicense, as entities engaging in virtual currency business activities as a limited purpose trust company or a banking organization will continue to be assessed under 23 NYCRR Part 101.

BankInovation

MAY 1, 2023

JPMorgan Chase acquired First Republic Bank this morning after regulators stepped in over the weekend to facilitate the sale of the struggling bank — and is prepared to spend $2 billion integrating First Republic into its platform over the next 18 months.

CFPB Monitor

MAY 1, 2023

While it has only been a month since the CFPB issued its final rule to implement Section 1071 of the Dodd-Frank Act, the CFPB is already facing a lawsuit challenging the rule’s validity. The lawsuit was filed last week in a Texas federal district court by the Texas Bankers Association and Rio Bank, McAllen, Texas. .

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

BankInovation

MAY 1, 2023

Fintech accelerator Expert Dojo, a former client of Silicon Valley Bank, moved some of its deposits to First Republic Bank in March to strengthen the bank’s deposits and help avoid a similar fate to SVB — which was ultimately unsuccessful.

TheGuardian

MAY 1, 2023

Forecast to post a combined $16.2bn six-month profit, the big four are facing a looming plateau – but analysts expect strong earnings to continue Get our morning and afternoon news emails , free app or daily news podcast Australia’s big four banks, forecast to post a combined $16.2bn six-month cash profit when they release their results over the next week, have motored through a cost of living crisis, increasing margins as they lift lending rates.

BankInovation

MAY 1, 2023

JPMorgan Chase & Co. agreed to acquire First Republic Bank in a government-led deal for the failed lender, putting to rest one of the biggest troubled banks remaining after turmoil engulfed the industry in March.

The Paypers

MAY 1, 2023

Forensic devices and identity verification solutions provider Regula has issued a survey showcasing that AI-generated identity fraud like deepfakes affects a third of businesses.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

The Banker

MAY 1, 2023

The EU is just the first jurisdiction to require UPI reporting, with the UK, US and Australia also publishing mandates. Compliance deadlines will be swift to follow. Sarah Kocianski reports.

The Paypers

MAY 1, 2023

The EY organisation has allied with insurance platform EIS to help clients in the US and UK in implementing and integrating EIS’ cloud-native digital insurance platform.

The Paypers

MAY 1, 2023

Binance.US has revealed that it will back out of a deal to purchase USD 1 billion of bankrupt cryptocurrency brokerage Voyager Digital assets.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

The Paypers

MAY 1, 2023

B2B payments company TransferMate has been granted authorisation as an Electronic Money Institution (EMI) by the Central Bank of Ireland.

The Paypers

MAY 1, 2023

WebID Solutions and CRIF Germany have announced a strategic cooperation in areas including banking, financial services, mobility, telecommunications, and ecommerce.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

The Paypers

MAY 1, 2023

The Bank of New York Mellon (BNY Mellon) has been implementing an artificial intelligence (AI) based tool to help with entity resolution in its customer database.

The Paypers

MAY 1, 2023

A court in California has deemed Apple ’s anti-steering provision unlawful as it prevented developers from using alternative in-app payment methods.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Let's personalize your content