Highlights From Federal Bank Regulators’ Joint Statement on Cryptocurrency Assets

Perficient

NOVEMBER 30, 2021

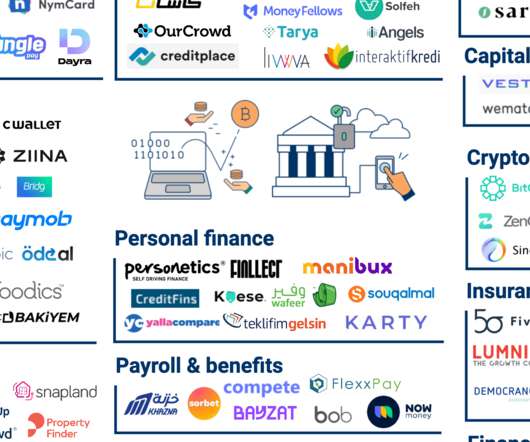

Recognizing that regulated and non-regulated financial institutions seek to engage in cryptocurrency and crypto asset activities, the three largest federal bank regulators, the Federal Reserve, the Federal Deposit Insurance Corporation, and the Office of the Comptroller of the Currency, recently issued a joint statement on crypto assets. The regulators broadly defined crypto assets as any digital asset implemented using cryptographic techniques.

Let's personalize your content