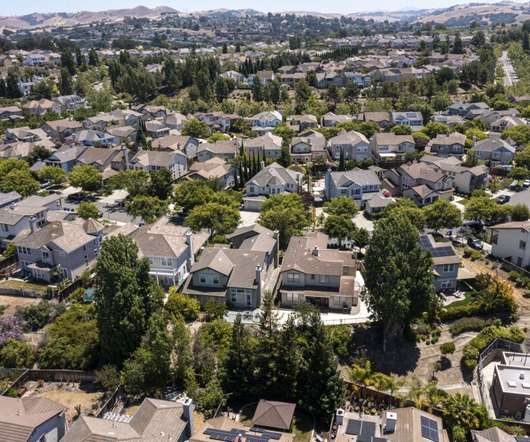

Study: Construction loan monitoring decreases loan defaults

Abrigo

SEPTEMBER 15, 2022

Monitoring construction loans improves outcomes, study finds. Researchers find construction loans with more on-site inspections are less likely to default, suggesting that loan monitoring adds value to lenders. You might also like this webinar, "How to manage a high-performing construction loan portfolio." WATCH. Takeaway 1 "Bank Monitoring with On-Site Inspections" will be presented later this month and claims to be the first empirical study of bank monitoring within non-syndicated loans. .

Let's personalize your content