How remote tellers may change the banking experience

Payments Dive

MAY 29, 2020

RBR associate Daniel Dawson explains why video banking may provide a solution for financial institutions concerned about social distancing when they finally reopen.

Payments Dive

MAY 29, 2020

RBR associate Daniel Dawson explains why video banking may provide a solution for financial institutions concerned about social distancing when they finally reopen.

PYMNTS

MAY 29, 2020

To monitor a home and to make sure all is safe and secure means you have to monitor the people and the activities inside. How to do that without destroying privacy in the age of work from home, shop from home, do-everything from home? In the age of connected devices, it may be that the sensor can go a long way toward eliminating that all standby, the unblinking eye of the camera — always on, and perhaps intrusive.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Source

MAY 29, 2020

U.K. fintechs are using their technology to assist British businesses and consumers during the coronavirus pandemic by helping banks disburse emergency business loans, enabling e-commerce merchants to offer installment payments to consumers, and giving employees access to salary advances.

PYMNTS

MAY 29, 2020

Financial institutions (FIs) have been adapting their platforms and technologies to better suit the needs of more digital consumers for decades, but the coronavirus has placed new importance and pressure on accelerating these efforts. Allowing customers uninterrupted access to their online financial accounts and processing digital payments quickly is critical during this time as brick-and-mortar branches are either closed or on limited hours.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

Payments Source

MAY 29, 2020

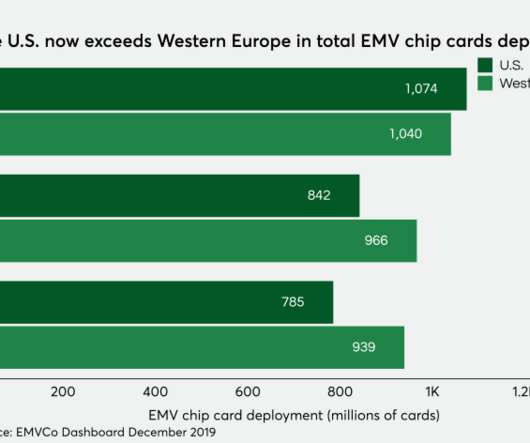

American financial institutions have surpassed 1 billion EMV chip cards in force to take second place in total EMV cards deployed, behind only the global leader, Asia Pacific.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

ATM Marketplace

MAY 29, 2020

With the country beginning to get back to business, many industries are looking for new ways to increase revenue. For the ATM industry, Bitcoin ATMs may be a viable option for the future.

PYMNTS

MAY 29, 2020

Sweden is winning the race among European nations to restore the economy from the coronavirus pandemic, according to data published on Friday (May 29), CNBC reported. The Nordic country reported its gross domestic product (GDP), a measure of economic health, grew at an annual rate of 0.4 percent from January through March. . Its growth may be the result of the nation’s decision not to impose a full lockdown to contain the spread of COVID-19. .

Payments Source

MAY 29, 2020

The modern mobile wallet no longer uses a card as a crutch. Instead, it sees it as an additional product that can add revenue from interchange, lending and loyalty.

PYMNTS

MAY 29, 2020

Bitcoin : not worth much – except what someone else is willing to pay for it. Goldman Sachs’ withering assessment of bitcoin this week may be enough to take some wind out of the sails of those who have been looking for the marquee name in crypto to find its way into mainstream commerce. As reported by the Financial Times , Goldman was once a staunch advocate of bitcoin, and had been, just a few years ago, examining whether to launch a bitcoin trading desk.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

Payments Source

MAY 29, 2020

Starling Bank has raised £40 million (about $49 million) in its latest fundraiser as it steps up its support for small businesses, bringing its 2020 total to £100 million (about $123 million).

PYMNTS

MAY 29, 2020

Mastercard ‘s new Recovery Insights tool will attempt to help businesses and governments assess data during the pandemic in order to make smarter decisions, according to a press release. The tool will attempt to help an array of businesses, including airlines, restaurants, banks, governments and other types of money-making and governing entities, said Mastercard President of Data and Services Raj Seshadri.

BankInovation

MAY 29, 2020

Bank of America is the latest financial institution to enhance its self-directed investment platform with artificial intelligence. The a move is designed to deliver more timely analysis and personalized content to customers, according to Cory Triolo, a consumer investments digital solutions and experience executive at the bank. The new capabilities, called “Dynamic Insights,” are directly […].

PYMNTS

MAY 29, 2020

Access to capital for small- to medium-sized businesses ( SMBs ) has always been vital, as well as a challenge. Borrowers don’t always have a consistent experience in their hunt for financing, either. In some cases, when a traditional bank shuts the door on an SMB applicant, a business owner may not know where else to turn for capital. In other scenarios, an SMB may be overwhelmed with a plethora of loan products, each designed for different purposes with unique requirements and costs.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

BankDeals

MAY 29, 2020

The federal government released its monthly Personal Income and Outlays report this morning, and it shows a surge in the personal savings rate.

PYMNTS

MAY 29, 2020

After officially shutting its doors in mid-March and furloughing staff, Disney World is planning its comeback. The park has officially scheduled a grand reopening for July. Disney officials plan a phased reopening that will see the Magic Kingdom and Animal Kingdom parks fire back up on July 11, followed by Epcot Center and Disney’s Hollywood Studios park on July 15.

Payments Source

MAY 29, 2020

Merchants should also monitor fraud by channel, to see how much each channel contributes to total fraud losses, says ClearSales's Bernardo Lustosa.

PYMNTS

MAY 29, 2020

The first half of 2020 has been particularly grueling for the travel industry. Jeff Cavins , CEO of recreational-vehicle rental site Outdoorsy , likens it to the entire planet “getting hit by a meteor” in terms of what it did to consumer interest in travel. Cavins and other industry all-stars recently joined Karen Webster for a panel discussion titled, Being There: Travel and Hospitality Remade for Generation COVID-19.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

BankInovation

MAY 29, 2020

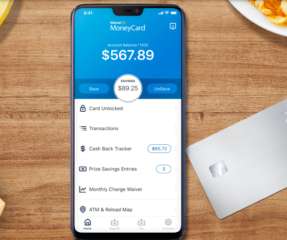

Green Dot’s banking-as-a-service business made headlines this week, including expanded products for both Walmart and Remitly customers. The company, which has long made money from prepaid reloadable cards, is finding new ways to connect with consumers through its platform business. Wells Fargo, meanwhile, is developing educational resources for business clients experiencing a wave of fraud […].

PYMNTS

MAY 29, 2020

To help save at least some top line, to perhaps even help margins a bit — enter the COVID-19 surcharge. Businesses across a variety of verticals have, in isolated cases, started charging end users to help defray the costs of cleaning, disinfecting and other processes tied to battling the pandemic. In other cases, COVID-related fees have started to appear in tandem with healthcare-related services.

BankInovation

MAY 29, 2020

IBM made headlines for beating Garry Kasparov at chess in 1997, and Ken Jennings at Jeopardy in 2011. Now, HSBC is turning IBM’s Watson into a stock picker. “Some of [our clients] might not be overly familiar with artificial intelligence or machine learning technology. It might be the first time they have encountered it, and […].

PYMNTS

MAY 29, 2020

More than 2,000 people who had signed employment agreements with Google as temp and contract workers had their offers rescinded, The New York Times reported. As the California-based search giant deals with shrinking ad revenues caused by COVID-19, Google told employment agencies about its decision in an email last week, the newspaper reported. “We’re slowing our pace of hiring and investment, and are not bringing on as many new starters as we had planned at the beginning of the year,” Google sai

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

BankInovation

MAY 29, 2020

Fresh off a $150 million funding round announced Thursday, Marqeta is developing a credit card product. The Oakland, Calif.-based startup raised the funds as an extension of its Series E from an undisclosed investor, more than doubling its valuation to $4.3 billion, up from $1.9 billion last year. “We took $150 million from an investor […].

PYMNTS

MAY 29, 2020

The consumer savings rate hit a historic 33 percent in April, as Americans hunkered down amid COVID-19, the U.S. Bureau of Economic Analysis (BEA) announced Friday (May 29). “There is a tremendous uncertainty and virus fear that is lingering and that is restraining people’s desire to go out and spend as they normally would,” Gregory Daco, chief U.S. economist at Oxford Economics told CNBC.

American Banker

MAY 29, 2020

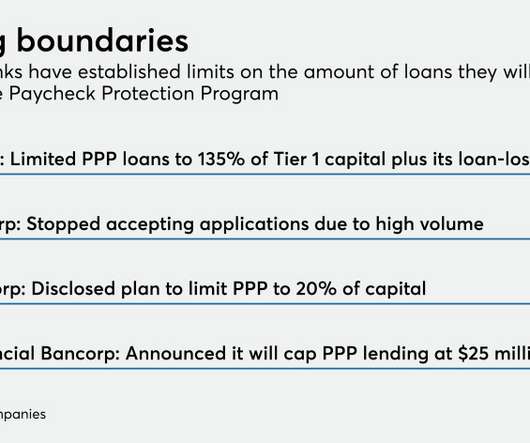

Many lenders are paying close attention to liquidity and capital ratios. Others are trying to avoid overtaxing employees who process, service and handle forgiveness of the loans.

PYMNTS

MAY 29, 2020

The digital shift has come to Nordstrom , and not a moment too soon. The department store chain earned a respectable first quarter as announced Thursday (May 28) through a mix of shrewd inventory management, financial reorganization and eCommerce strength. While pointing out that it ended calendar 2019 in solid condition, the chain logged positive results in February in-store sales and ongoing growth of its $5 billion eCommerce business.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Let's personalize your content