Walmart lashes back at FTC over money-transfer lawsuit

Payments Dive

JULY 6, 2022

In a fiery rebuttal to the Federal Trade Commission lawsuit last week, the nation’s biggest retailer is already doing battle in the court of public opinion.

Payments Dive

JULY 6, 2022

In a fiery rebuttal to the Federal Trade Commission lawsuit last week, the nation’s biggest retailer is already doing battle in the court of public opinion.

South State Correspondent

JULY 6, 2022

In an earlier article, we discussed how we use “cost per impression” as a metric for planning, budgeting, and executing bank events that are specific for customer retention and branding. In this post, we expand that analysis and apply it to those events that a bank hosts or participates in designed to generate leads (“lead gen”) for product sales.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

JULY 6, 2022

Fintechs and financial services players will "be the driver of innovations and regulations that enable stablecoins, crypto and other digital assets to scale," argues Metallicus Chief Financial Officer Irina Berkon.

CFPB Monitor

JULY 6, 2022

The CFPB has published its Spring 2022 rulemaking agenda as part of the Spring 2022 Unified Agenda of Federal Regulatory and Deregulatory Actions. The agenda’s preamble indicates that the information in the agenda is current as of April 1, 2022 and identifies the regulatory matters that the Bureau “reasonably anticipates having under consideration during the period from June 1, 2022 to May 31, 2023.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

Payments Dive

JULY 6, 2022

The crypto payment company that partners with digital wallet providers said it’s providing its 15 million end-users worldwide with the ability to load or cash out of digital currencies.

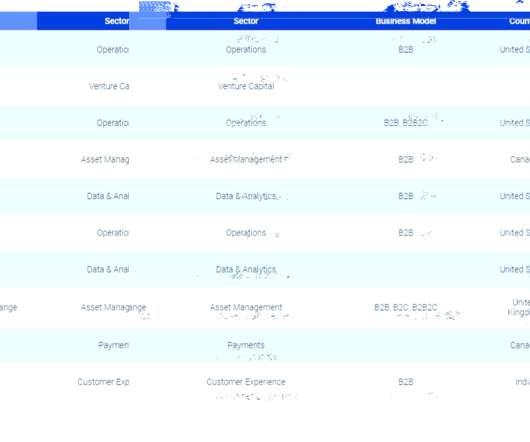

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Dive

JULY 6, 2022

With the settlement, the brand licensing company has acquired a stake in the online checkout startup.

BankUnderground

JULY 6, 2022

Mahmoud Fatouh and Ioana Neam?u. Since 2009, contingent convertible (CoCo) bonds have become a popular instrument European banks use to partially meet their capital requirements. CoCo bonds have a loss-absorption mechanism (LAM). When LAM is triggered, the bonds convert to equity capital or have their principal written down, providing more loss-absorbing capacity while a bank is still a going concern.

BankInovation

JULY 6, 2022

Direct bank payments company GoCardless plans to acquire open banking data provider Nordigen later this summer in a move to grow its bank payments network, the companies announced Friday. Terms of the deal were not released. Latvia-based Nordigen is a free, open-banking platform that provides access to data and premium insights to more than 2,300 […].

The Paypers

JULY 6, 2022

hi , a next-gen fiat/crypto mobile banking platform, has introduced personal International Bank Account Numbers (IBANs) for EUR and GBP deposits and withdrawals.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

BankInovation

JULY 6, 2022

Bank of America recently announced it is extending its multiyear partnership with asset and wealth management investment platform iCapital. The New York-based fintech iCapital provides a digital approach for investors and advisors who are investing their clients’ assets into private funds, offering an automated version of what was once a manual process, iCapital Chief Information […].

The Paypers

JULY 6, 2022

Europe-based Open Banking platform TrueLayer has announced its collaboration with wealth-building app Chip to deliver enhanced customer experience through faster account payments.

The Emmerich Group

JULY 6, 2022

And hear your customers say, “I Don’t Want To Work With Any Bank But You.” If you don’t care about bank premium pricing, you can stop listening right now. This is for bank executives who want to figure out how to command premium pricing despite the too-common assumption that banking is a commodity. Therefore, they. Continue Reading. The post How To Command Bank Premium Pricing appeared first on Roxanne Emmerich.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

The Paypers

JULY 6, 2022

The Central Bank of Nigeria (CBN) has announced a significant adjustment to the QR Code Framework procedure, allowing both merchants and consumers to pay via QR codes.

American Banker

JULY 6, 2022

The Paypers

JULY 6, 2022

Australia-based Buy Now, Pay Later operator Openpay has closed operations in the US, in a push to keep up with heightened costs and lower market traction for BNPL.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

The Paypers

JULY 6, 2022

Cryptocurrency exchange BitMEX has announced plans to increase compliance with the European sanctions against Russia by preparing to enforce major restrictions for its Russian users.

The Paypers

JULY 6, 2022

UK-based Buy Now, Pay Later startup Raylo has raised EUR 7.5 million in its latest funding round.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

The Paypers

JULY 6, 2022

The Netherlands-based IBAN-Name check provider fintech SurePay has announced a new partnership with Consortium of Italian Banks (CBI ), an Italy-based company developing digital and financial services for the fintech industry.

The Paypers

JULY 6, 2022

Business banking provider Tide has planned to release its Business Account in India, allowing Indian SMEs to load money onto a Tide Expense Card, collect and make payments, and check and track spending, according to AltFi.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Let's personalize your content