5 Banking Trends We’re Forecasting for 2023

Perficient

JANUARY 25, 2023

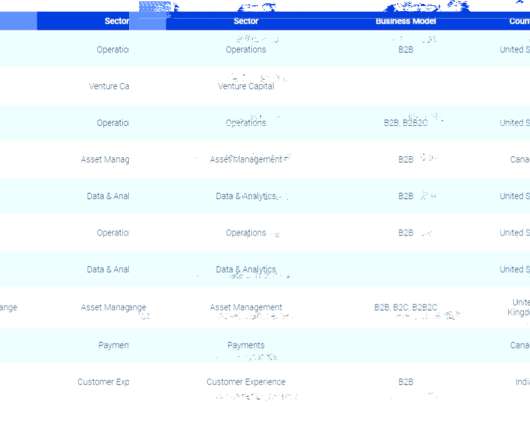

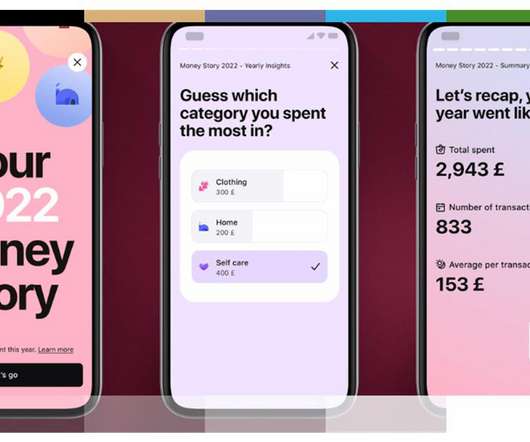

2023 has commenced, and rates are climbing, inflation is bubbling, and banking customers are continuing to demand hyper-personalized products and experiences from their institutions. Here are five banking trends we’re forecasting for the new year. 1. Banks are focused on efficiency initiatives to optimize their operations and lower costs. Three prominent areas where there is a strong desire to optimize: Data.

Let's personalize your content