Deep Dive: How Prepaid Cards Support Faster, More Accessible Employee Compensation

PYMNTS

NOVEMBER 20, 2020

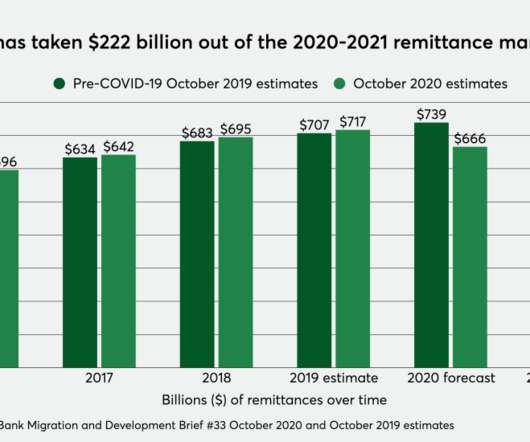

Companies with global workforces need to overcome numerous challenges to quickly and easily pay their employees. Providing prompt compensation is critical because workers’ loyalty could be damaged if frictions affect their paychecks. Employees’ payment preferences and access to financial tools can vary, however. . Firms recognize that not all employees can receive payments into bank accounts, and these companies must therefore provide secure, convenient alternatives.

Let's personalize your content