Five Simple Commands to Manage Your AWS EC2 Instances Using the CLI

Perficient

FEBRUARY 5, 2021

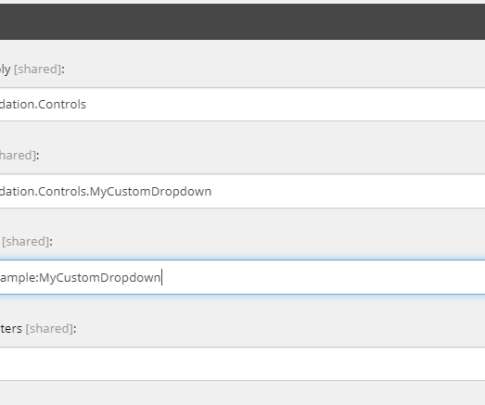

I have a lab environment in Amazon Web Services (AWS) that consists of four small EC2 instances. When I’m not using the lab, I shut the instances down and then start them up when I need them. When I do this, they get new public IP addresses, and I need to know those addresses in order to connect to them. I wanted to simplify this whole process by using the AWS command line utility (CLI).

Let's personalize your content