RegTech versus TechReg

Chris Skinner

FEBRUARY 6, 2020

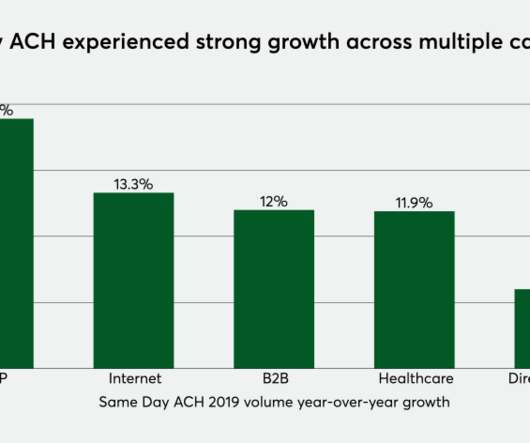

I often talk about how banks have five times more regulation than technology firms. That stat comes from Bank of America Merrill Lynch who published this chart a while ago: This is confirmed by similar charts, such as this one from Benedict Evans, a Partner at the firm Andreessen Horowitz, … The post RegTech versus TechReg appeared first on Chris Skinner's blog.

Let's personalize your content