3 key areas where payments can empower telecoms

Accenture

JULY 19, 2022

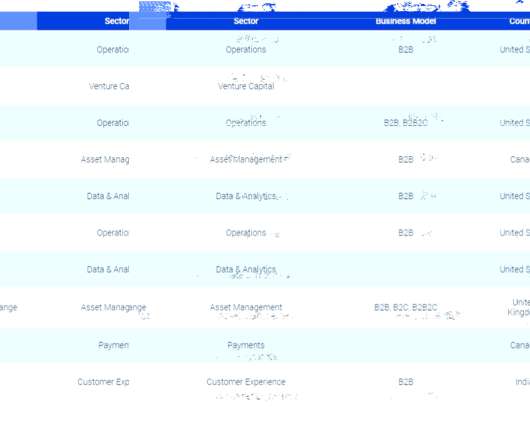

Telecom firms play a critical role in connecting people: 85% of the US population use smartphones today, and the penetration rate in the UK has reached 92%. This access to a massive market creates a unique opportunity for the key telecoms players to offer streamlined, end-to-end customer journeys, which can be powered by frictionless digital…. The post 3 key areas where payments can empower telecoms appeared first on Accenture Banking Blog.

Let's personalize your content