The failure of banks (#coronavirus)

Chris Skinner

MAY 10, 2020

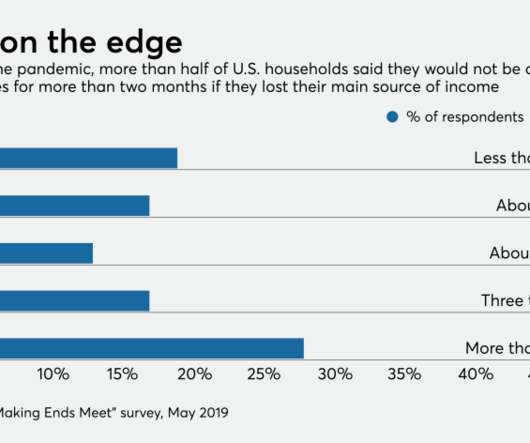

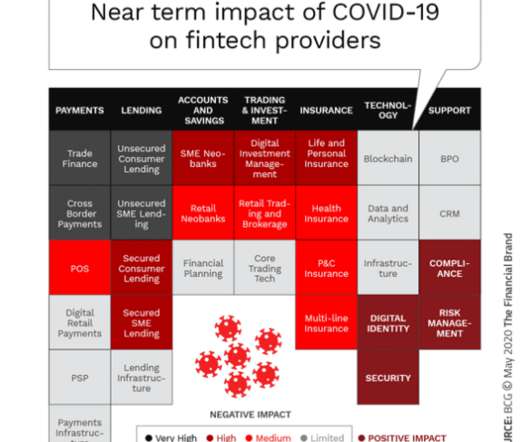

The other day, I blogged about the failure of government in this crisis. Today, I’m blogging about the failure of banks. I am aware that in some countries – the Netherlands seems to be one – there has been great continuance of bank service. Unfortunately, the UK is proving to … The post The failure of banks (#coronavirus) appeared first on Chris Skinner's blog.

Let's personalize your content