2020: No Vision (I thought we were an autonomous collective)

Chris Skinner

JUNE 14, 2020

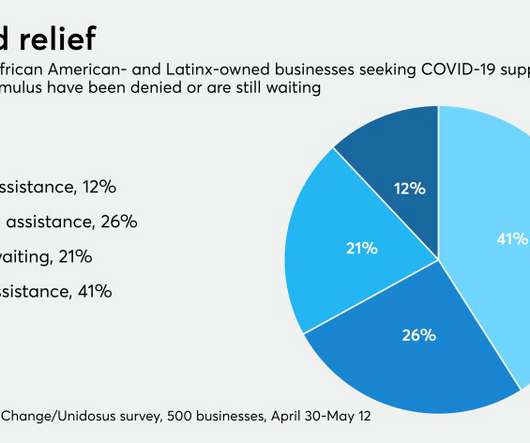

Like many, I’ve watched 2020 unfold with a mixture of shock and horror. It began with Australian bushfires followed rapidly by the coronavirus pandemic and now the Black Lives Matter demonstrations. My real shock was that there could be so many global demonstrations during a major global lockdown. Do rules … The post 2020: No Vision (I thought we were an autonomous collective) appeared first on Chris Skinner's blog.

Let's personalize your content