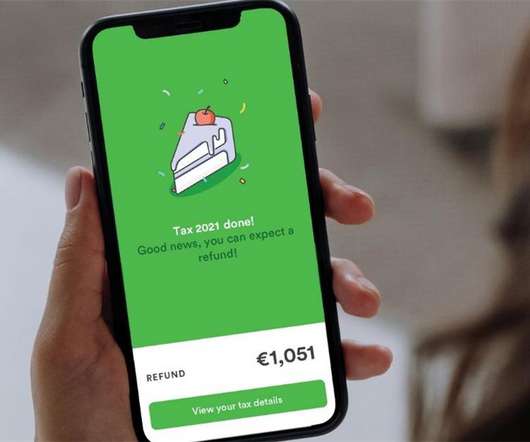

BNPL players' losses grow as costs soar

Payments Dive

MAY 3, 2022

Buy now-pay later providers are having to pay a hefty price to keep up with surging consumer demand for their financing services, spending large sums to add new technology and more employees. As a result, their expenses are rising at a much faster rate than their revenue, meaning most of the major players are posting losses despite the BNPL mania.

Let's personalize your content