What payments can expect from Washington this year

Payments Dive

JANUARY 18, 2023

From buy now, pay later to peer-to-peer payment fraud, there’s no shortage of payments targets for lawmakers and regulators.

Payments Dive

JANUARY 18, 2023

From buy now, pay later to peer-to-peer payment fraud, there’s no shortage of payments targets for lawmakers and regulators.

South State Correspondent

JANUARY 18, 2023

Prepayment penalties on loans always drive value. However, in 2023, loan prepayment provisions will be essential tools for commercial banks. Loan prepayment provisions lower prepayment speeds (especially in a stable or declining interest rate environment) and drive higher return on assets (ROA) for banks. In this article, while we have discussed how to sell prepayment penalties in the past, we now look at their current importance.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

JANUARY 18, 2023

A growing number of companies are bringing buy now, pay later to the rental market as inflation drives up housing costs and renters struggle to pay on time.

South State Correspondent

JANUARY 18, 2023

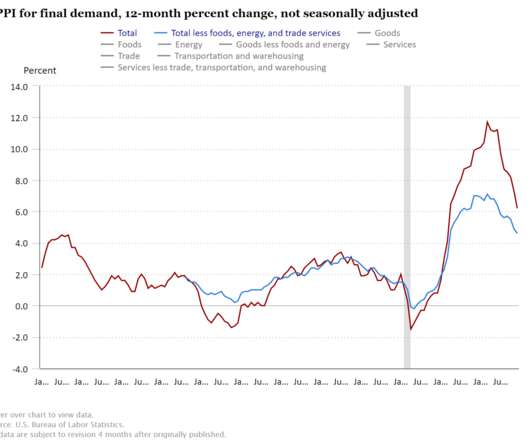

Retail Sales & PPI Reveal Softening Activity. Treasury prices are rallying some in early trading as overnight news from Japan is aiding the bid. The Bank of Japan decided not to widen the band on its Yield Curve Control policy for their 10yr bond from the current -50bps +50bps range. By not widening the range, and implicitly denying higher yields, foreign markets are reacting to the dovish action by rallying their local bonds as is the case here, but we do have some domestic news items that

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

Payments Dive

JANUARY 18, 2023

With the 10% workforce reduction, the Canadian merchant payment services company is reorganizing in a bid for profitability.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Dive

JANUARY 18, 2023

Venture funding for payments companies dropped 50% globally last year too, but they attracted more than other fintechs in the fourth quarter.

Banking Exchange

JANUARY 18, 2023

Research suggests a handful of banks are helping payday lenders avoid state regulations to offer high-interest consumer loans Compliance Duties Feature Feature3 Community Banking

Payments Dive

JANUARY 18, 2023

The supermarket operator teamed with tech firm Trigo to open an autonomous convenience store at its New Jersey corporate campus.

CFPB Monitor

JANUARY 18, 2023

The New York Department of Financial Services (DFS) recently issued proposed guidance (Guidance) related to climate change that applies to New York State-regulated banking organizations, New York State-licensed branches and agencies of foreign banking organizations, and New York State-regulated mortgage.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

TheGuardian

JANUARY 18, 2023

Suit filed by victim against JP Morgan alleges Jes Staley knew of trafficking of young women and witnessed sexual abuse Jes Staley, the former boss of Barclays, has been accused in documents lodged at a US court of “personally observ[ing] the sexual abuse of young women” by Jeffrey Epstein. Staley, 66, who resigned as chief executive of Barclays in November 2021 after a preliminary investigation by the UK regulators into his relationship with Epstein, is named in a lawsuit filed by one of Epstei

CFPB Monitor

JANUARY 18, 2023

Community Financial Services Association (CFSA) has filed its brief in opposition to the CFPB’s certiorari petition seeking review of the Fifth Circuit panel decision in Community Financial Services Association of America Ltd. v. CFPB. In that decision, the panel.

Banking Exchange

JANUARY 18, 2023

US banks are less likely to be spending big on acquisitions amid continued economic uncertainty Management Feature M&A Feature3 Community Banking Financial Research The Economy

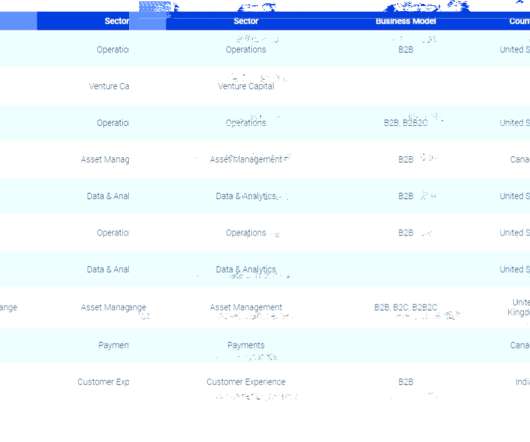

CB Insights

JANUARY 18, 2023

Global fintech funding reached $75.2B in 2022 — marking a 46% drop from 2021, but up 52% compared to 2020. The funding slowdown was especially severe in the second half of the year, with Q4’22 funding clocking in at $10.7B — the lowest quarterly level since 2018. Overall, deals fell 8% year-over-year to reached 5,048 in 2022. Africa was the only major region to see deals increase compared to 2021.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

The Paypers

JANUARY 18, 2023

Philippines-based consumer finance app BillEase has partnered with Alipay+ to allow Filipino consumers to use Buy Now, Pay Later (BNPL) when shopping online.

BankInovation

JANUARY 18, 2023

The combination of today’s uncertain macroeconomic conditions and the Consumer Financial Protection Bureau’s new open banking rule coming this year has consumers wanting quick access to cash from their banks under the watchful eye of regulators.

The Paypers

JANUARY 18, 2023

The final vote for the European Union ’s crypto regulation bill, MiCA , has been postponed until April 2023 due to technical difficulties.

FICO

JANUARY 18, 2023

Home. Blog. FICO. The State of Responsible AI in Financial Services. The third annual State of Responsible AI in Financial Services report released today, alerting the industry to come together and self-regulate its use of AI. FICO Admin. Thu, 12/19/2019 - 16:29. by Scott Zoldi. Chief Analytics Officer. expand_less Back To Top. Wed, 01/18/2023 - 22:50.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

BankInovation

JANUARY 18, 2023

Layoffs that began in 2022 are accelerating across much of the technology world. The tech industry is slashing jobs at a pace nearing the early days of the Covid-19 pandemic. In November, the most recent month for which data is available, the sector announced 52,771 cuts, for a total of 80,978 over the course of the year, according to […].

The Paypers

JANUARY 18, 2023

The Russian Vedomosti news agency has revealed in an article that Russia and Iran are gearing up to launch a new gold-backed stablecoin.

BankInovation

JANUARY 18, 2023

PNC is planning to increase spending for its technology development program this year after reducing noninterest expenses through workforce cuts in the fourth quarter of 2022 in preparation for an economic downturn. WHY IT MATTERS: Personnel-related expenses were down 5% year over year to $1.9 billion in Q4 but were up 8% sequentially, driven […].

The Paypers

JANUARY 18, 2023

Canadian payments solution Lynk has announced it has added Pay by Bank to its platform.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

BankInovation

JANUARY 18, 2023

Discover Financial Services’ Joe Mills, director of transformation strategy and automation, and Dan Ireland, senior manager of automation and businesses strategy, have joined Bank Automation Summit U.S. 2023 to speak on robotic process automation and automation operations. View the full agenda for Bank Automation Summit U.S. 2023 here. Mills will join the panel “Automation operations: […].

The Paypers

JANUARY 18, 2023

Real-time payments software provider ACI Worldwide has launched an instant payments solution to enable US-based merchants to accept online, mobile, and in-store payments instantly.

American Banker

JANUARY 18, 2023

The Paypers

JANUARY 18, 2023

France-based paytech Ingenico has partnered Fujitsu Frontech North America to launch a biometric payment solution based on palm vein identification.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Let's personalize your content