Visa sees long runway with cash-to-card transition

Payments Dive

JUNE 9, 2022

For Visa, plenty of opportunity remains in cash-to-card digitization, offsetting any slowdown in consumer spending, CFO Vasant Prabhu said this week.

Payments Dive

JUNE 9, 2022

For Visa, plenty of opportunity remains in cash-to-card digitization, offsetting any slowdown in consumer spending, CFO Vasant Prabhu said this week.

South State Correspondent

JUNE 9, 2022

Many community banks are searching for ways to increase fee income, and many bank CEOs have concluded that fee income is a significant driver of revenue and profitability. We argue that larger banks do not have an inherent advantage over community banks in generating fee income because of their scale. Most fee income generated by larger banks is not related to investment banking, wealth management, cryptocurrency, or Fintech.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

ABA Community Banking

JUNE 9, 2022

The ABA Stonier Graduate School of Banking recognized 118 graduates yesterday, awarding Stonier diplomas and Wharton leadership certificates. The post ABA Stonier School Graduates 118 appeared first on ABA Banking Journal.

CFPB Monitor

JUNE 9, 2022

We first share our perspective on Director Chopra’s approach to his leadership role and use of the CFPB’s authority, his priorities, and political dynamics impacting the CFPB. We then discuss the CFPB’s activity during Director Chopra’s initial months in office, including its request for information on “junk fees” and criticism of overdraft and credit card late fee practices, requests to large tech firms regarding payment services, fintech focus (and use of risk-based supervision), use of UDAA

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

Bobsguide

JUNE 9, 2022

NXTsoft is excited to provide OmniConnect API connectivity to Manufacturers Bank & Trust, headquartered in Forest City, IA. NXTsoft is providing connectivity between MBT’s ancillary systems and its Jack Henry Silverlake core processing system. Utilizing OmniConnect API connectivity can help financial institutions to increase productivity without hiring additional staff, eliminate all manual loan boarding and funding processes and reduce compliance impact among other benefits.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

The Paypers

JUNE 9, 2022

Brazil-based fintech Zippi has raised USD 16 million for a credit solution via PIX for micro-entrepreneurs.

FICO

JUNE 9, 2022

Home. Blog. FICO. Enterprise Intelligence: 5 Steps to Ending a Whac-a-Mole Approach. If you are reacting to customer and competitor actions, you are already behind; but enterprise intelligence can get you back in the game. FICO. Tue, 07/02/2019 - 02:45. by Jim Neumann. expand_less Back To Top. Thu, 06/16/2022 - 13:00. Executives responsible building and marketing compelling customer experiences in financial services and insurance – or those responsible for customer service and retention – must f

Bussman Advisory

JUNE 9, 2022

FinTech Ecosystem Insights by Bussmann Advisory is our weekly newsletter with over 40’000 subscribers across different social media channels, summarizing relevant news and reports related to ecosystems around disruptive technologies, highlighting key updates from the industry as well as our portfolio companies: Apple sidelines Goldman Sachs and goes in-house for lending service Citigroup plans to hire 4,000 tech staff to tap into ‘digital explosion’ Deutsche Bank moves half of its Russia-b

BankInovation

JUNE 9, 2022

Cincinnati-based Fifth Third Bank recently executed three key automation projects, including the launch of automated lockbox products that deliver check payments to a business or individual’s designated address. “Despite online payment options and [the Automated Clearing House], physical checks remain a very popular form of payment,” Jude Schramm, chief information officer, told Bank Automation News.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

FICO

JUNE 9, 2022

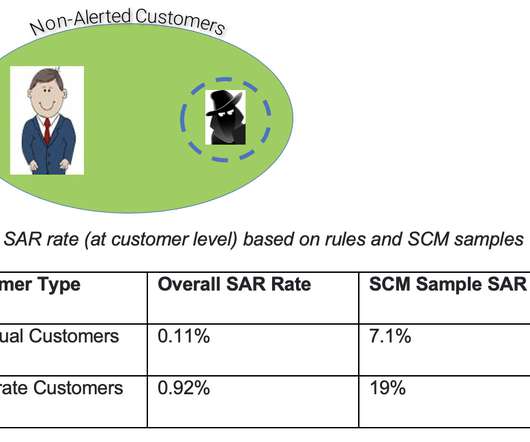

Home. Blog. FICO. FICO’s New AML Scores Use AI and Machine Learning to Detect More Money Laundering. New AML scores reduce false positive alerts by 50% while detecting 100% of known money laundering transactions, and discover new aberrant, potentially risky behaviors. asokolowski@speednet.pl. Fri, 06/03/2022 - 12:24. by Scott Zoldi. expand_less Back To Top.

BankInovation

JUNE 9, 2022

The Consumer Financial Protection Bureau (CFPB) placed artificial intelligence (AI)- and machine learning (ML)-powered credit decisioning into its crosshairs last week, with documentation likely being key to satisfying the regulator’s inquiries. Under the Equal Credit Opportunity Act (ECOA), creditors are required to send adverse action notices to consumers who are denied credit, explaining why they were not offered […].

TheGuardian

JUNE 9, 2022

Law Commission review of corporate criminal liability in England and Wales also criticised by campaigners Law Commission proposals to make directors more accountable for economic crimes at the companies they oversee have been condemned as a “thundering disappointment”. MPs from the all-party parliamentary group (APPG) on anti-corruption and responsible tax criticised the proposals for England and Wales, published on Friday, as “unambitious, uninspired and insipid”, saying the Law Commission had

BankInovation

JUNE 9, 2022

The years of anticipation surrounding the development and adoption of Federal Reserve instant payment service FedNow is a case of much ado about nothing at the bank level. Although industry experts have wondered what the upcoming adoption of FedNow will look like at financial institutions — especially community banks and credit unions —the onus will […].

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

The Paypers

JUNE 9, 2022

Universal API for small business data company, Codat , has announced it raised USD 100 million in a Series C funding round led by JP Morgan Growth Equity Partners.

American Banker

JUNE 9, 2022

The Paypers

JUNE 9, 2022

UK-based digital payments company Pomelo Pay has partnered connectivity provider Dialog Axiata to provide a digital payment platform for SMEs in Sri Lanka.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

The Paypers

JUNE 9, 2022

Mastercard has delivered its payment feature ‘Pay by link’ in partnership with Denmark-based fintech Aiia , so businesses can accept payments anywhere.

The Banker

JUNE 9, 2022

A series of consultations and the recent setting up of the ISSB is fostering optimism among bankers that the world may eventually coalesce around global ESG standards. By Justin Pugsley.

The Paypers

JUNE 9, 2022

Lithuania-based fintech kevin. has appointed Sentinels , an intelligent transaction monitoring platform, to handle its transaction monitoring compliance.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

The Paypers

JUNE 9, 2022

Backbase , a Netherlands-based Engagement Banking Platform, has raised EUR 120 million in growth equity funding from Motive Partners.

The Paypers

JUNE 9, 2022

US-based fintech PXP Financial has teamed up with Discover Global Network to extend payment capabilities.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Let's personalize your content