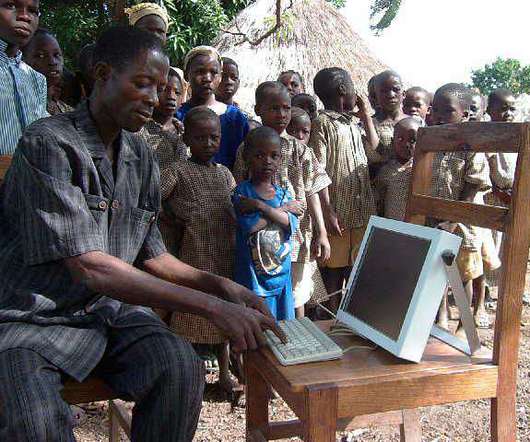

Digital Banking for the Poor

Chris Skinner

JULY 13, 2020

I have a few friends around the world that I pick up on, and The World Bank and CGAP are amongst that crew. Therefore, when I saw that Peter Zetterli, senior financial sector specialist with CGAP, was blogging about financial inclusion I couldn’t but help reach out to him and … The post Digital Banking for the Poor appeared first on Chris Skinner's blog.

Let's personalize your content