Card debt weighs on consumers

Payments Dive

MAY 16, 2023

First-quarter credit card balances jumped 17% over the same period last year, according to New York Fed data.

Payments Dive

MAY 16, 2023

First-quarter credit card balances jumped 17% over the same period last year, according to New York Fed data.

ATM Marketplace

MAY 16, 2023

Is traditional banking dead? Or is it transforming? The answer may lie in keeping the traditional touch while integrating innovative technology: like Valley Bank's recent digital signage makeover.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

MAY 16, 2023

The digital payments pioneer faces pressure from investors to name CEO Dan Schulman’s successor sooner rather than later.

FICO

MAY 16, 2023

Home Blog Feed test FICO and Chelsea Football Club to Raise Financial Literacy in U.S. Strategic partnership between Chelsea FC and FICO aims to make a positive impact on the communities where games are played Tue, 05/16/2023 - 18:46 Saxon Shirley by Nikhil Behl Chief Marketing Officer expand_less Back to top Tue, 05/16/2023 - 18:35 Chelsea Football Club today announced a new partnership with FICO, the world’s leading provider of analytics software, solutions and services.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

CB Insights

MAY 16, 2023

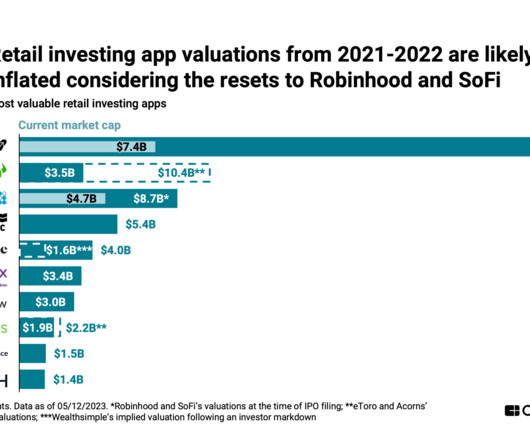

Robinhood ’s Q1’23 earnings paint a grim picture of the profitability and growth challenges that retail investing apps and other fintechs face today: Net losses are compounding Active users are at a fraction of previous peaks Transaction-based revenues are up and down from one quarter to the next but aren’t growing over time This is old news to the public markets, as Robinhood’s market capitalization is down 77% compared to its exit valuation at IPO in July 2021.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

The Paypers

MAY 16, 2023

Canada-based Advanced Payment Solutions has partnered with Armenotech and Tempo France to form an ecosystem based on the Stellar blockchain.

BankInovation

MAY 16, 2023

In 1975, Businessweek ran a story identifying the ways that technology would reshape the workplace. Leaders from Xerox and IBM correctly predicted that by 1995, offices would have an integrated network of personal computers at each desk and electronic filing systems.

The Paypers

MAY 16, 2023

Fintech BKN301 has partnered with Finastra to bring digital and cross-border payments solutions to San Marino and expedite its Banking-as-a-Service (BaaS) solution deployment for the MENA region.

BankInovation

MAY 16, 2023

Credit unions and smaller financial institutions are looking to no-code technology options to digitalize member experiences in order to stay competitive with fewer resources and less capital.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

The Paypers

MAY 16, 2023

Germany-based digital bank N26 has announced the launch of its new N26 Instant Savings account in Spain, aiming to offer eligible customers interest on deposits.

The Paypers

MAY 16, 2023

Cryptocurrency exchange Binance has announced that it will cease its operations in Canada due to new stablecoin and investor limits.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

The Paypers

MAY 16, 2023

Financial crime intelligence company ComplyAdvantage has launched a Fraud Detection solution that uses machine learning algorithms to detect and prevent transaction fraud.

American Banker

MAY 16, 2023

The Paypers

MAY 16, 2023

Digital wealth platform Yield App has partnered with UK-based real-time payments gateway Volt to offer additional GBP and EUR on-ramps via FPS and SEPA Instant.

American Banker

MAY 16, 2023

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

The Paypers

MAY 16, 2023

US-based fintech company Jack Henry has announced that it will contribute to the launch of the Federal Reserve ’s payment network, the FedNowSM Service.

The Paypers

MAY 16, 2023

Global retail management software Teamwork Commerce has announced the receipt of SOC 2 Type 1 compliance for all Teamwork Commerce Premier Edition customers.

American Banker

MAY 16, 2023

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

The Paypers

MAY 16, 2023

Zip has announced the launch of a unified platform for procurement, consolidating the tools and processes needed for the end-to-end procurement lifecycle.

The Paypers

MAY 16, 2023

US-based financial technology company Cardless has announced its raise of a USD 75 million three-year credit facility in a debt deal made with i80 Group.

The Financial Brand

MAY 16, 2023

This article Personal Loans Are a Growth Area with Cross-Sell Opportunities appeared first on The Financial Brand. Fintechs cultivate personal loan borrowers as long-term banking prospects. Can banks and credit unions compete? This article Personal Loans Are a Growth Area with Cross-Sell Opportunities appeared first on The Financial Brand.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Let's personalize your content