Papaya builds cross-border payroll services

Payments Dive

OCTOBER 28, 2022

The well-funded startup is taking on big clients and big rivals in seeking to offer cross-border payroll and payment services, with checks sent to workers in 72 hours.

Payments Dive

OCTOBER 28, 2022

The well-funded startup is taking on big clients and big rivals in seeking to offer cross-border payroll and payment services, with checks sent to workers in 72 hours.

Abrigo

OCTOBER 28, 2022

Managing loan workouts and modifications Tips for preparing your bank or credit union to handle an increased volume of problem loans while ensuring prudent credit risk management. You might also like this video, "A look at credit risk in a rising-rate environment." WATCH. Takeaway 1 Signs point to increased loan modifications and loan workouts, and regulators have urged financial institutions to work prudently with borrowers. .

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

OCTOBER 28, 2022

The company also credited cross-border travel, digital-first deals with banks and co-branding alliances for its performance during the quarter.

ATM Marketplace

OCTOBER 28, 2022

Louisville, Kentucky rock festival Louder than Life encouraged attendees to go cashless, but unfortunately the strategy hit several snags.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

BankInovation

OCTOBER 28, 2022

Global economic instability has made rough waters, and balancing the books nowadays is a tough job, to say the least. Conventional advice on how organizations should behave in a tumultuous economic environment has been to do everything possible to cut costs across departments and ride out the storm. However, paying little attention to furthering investments […].

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

TheGuardian

OCTOBER 28, 2022

Bank says there has been a slowdown in customers trying to get new mortgages in recent weeks Pre-tax profits at NatWest Group remained flat between July and September at £1.1bn, amid a worsening economic outlook and a cost of living squeeze on its customers, as the bank predicted UK house prices would fall by 7% next year. Its profits, boosted by higher interest rates increasing its margin between what it charged for loans and paid out to savers, were slightly higher than the £1bn made in the sa

The Paypers

OCTOBER 28, 2022

Swift has issued a press release, informing that, following the global community’s appeal, it decided to delay the ISO 20022 migration until March 2023.

Bussman Advisory

OCTOBER 28, 2022

FinTech Ecosystem Insights by Bussmann Advisory is our weekly newsletter with over 47’000 subscribers across different social media channels, summarizing relevant news and reports related to ecosystems around disruptive technologies, highlighting key updates from the industry as well as our portfolio companies: Credit Suisse to slash 9,000 jobs, hive off investment bank in radical overhaul European FinTech growth cools down Warner Bros launches collectible Superman comic NFTs.

BankInovation

OCTOBER 28, 2022

Amazon.com Inc. shares will fall another 28% and take longer to recover from a slump that has already wiped out $560 billion in market value, says BNP Paribas Exane’s Stefan Slowinski, the only analyst with a sell-rating on the e-commerce giant. Slowinski cut the stock’s 12-month price target to $80 per share, the lowest among […].

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

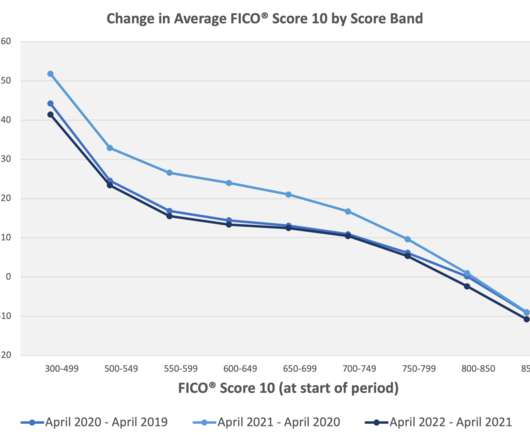

FICO

OCTOBER 28, 2022

Home. Blog. FICO. FICO Score 10, Most Predictive Credit Score in Canadian Market. FICO Score credit risk trends through the COVID-19 pandemic. FICO Admin. Tue, 07/02/2019 - 02:45. by Erik Franco. expand_less Back To Top. Fri, 10/28/2022 - 15:00. Twentieth century mathematician Claude Shannon said, “Information is the resolution of uncertainty”. We’re now two years removed from the onset of the COVID-19 pandemic, and the current economic outlook is perhaps more uncertain than ever as we face cont

BankInovation

OCTOBER 28, 2022

Capital One is modernizing its tech stack and increasing automation using machine learning (ML) within the bank’s systems. The $444 billion bank reported a 9% year-over-year increase in communications and data processing spend to $349 million during the third quarter, according to the company’s Q3 earnings presentation. The technology-focused investment will allow Capital One to […].

The Paypers

OCTOBER 28, 2022

UK-based Shufti Pro has partnered with permissioned DeFi platform Action Monkey and micro-investment app Xponent to offer secure customer onboarding.

BankInovation

OCTOBER 28, 2022

LAS VEGAS — Bank of America’s volume of direct transactions completed through digital channels has reached 75%, Tim Owens, consumer vehicle lending executive, said Thursday at the Auto Finance Summit in Las Vegas. Customers “love digital car shopping, but when they want to speak to someone … they want to speak to someone in the […].

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

The Paypers

OCTOBER 28, 2022

Blockchain.com has launched its Blockchain.com Visa Card , which leverages Visa’s payments network and Marqeta’s card issuing platform.

BankInovation

OCTOBER 28, 2022

LAS VEGAS – Wells Fargo is increasing its credit decisioning automation in an effort to enhance dealer satisfaction in its auto business. The bank’s automotive credit decisioning reached 70% automation in 2022, up from 50% in 2021, Head of Wells Fargo Auto Tanya Sanders said at the Auto Finance Summit on Thursday. “We spent the […].

The Paypers

OCTOBER 28, 2022

The Governing Council of the European Central Bank (ECB) has decided to recalibrate the conditions of the third series of targeted longer-term refinancing operations (TLTRO III) as part of the monetary policy measures adopted to restore price stability over the medium term.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

American Banker

OCTOBER 28, 2022

The Paypers

OCTOBER 28, 2022

The Monetary Authority of Singapore (MAS) has published two consultation papers aimed at reducing the risk of consumer harm from crypto trading and supporting stablecoins.

The Paypers

OCTOBER 28, 2022

UK-based remittance platform Wise has revealed plans to expand its investment services across Europe following the Assets product launch in Estonia.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

The Paypers

OCTOBER 28, 2022

US-based fintech Inswitch has partnered Binance to launch on-off ramp services in the context of rising cryptocurrency adoption in Latin America.

The Paypers

OCTOBER 28, 2022

Tipalti , an automated payables solution, has chosen BillingPlatform , an enterprise monetisation platform, as its enterprise billing solution.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Let's personalize your content