The Power of Knowledge: Driving Progress and Growth through Data

BankInovation

FEBRUARY 15, 2023

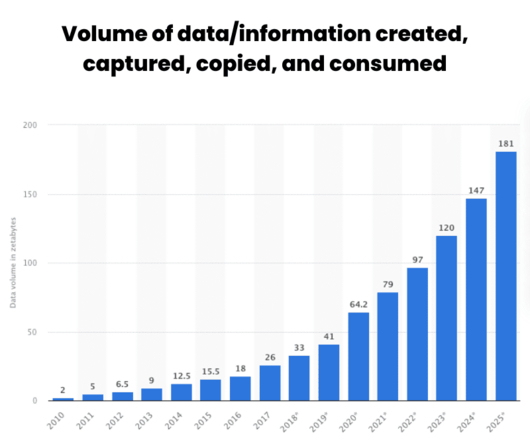

In today’s economic climate, leveraging data is a good way for banks to increase efficiency and save costs, positively impacting their bottom line. By leveraging their data, banks gain valuable insights and can align business objectives and strategy, leading to new growth opportunities.

Let's personalize your content