Preparing for the CBDC era

Payments Dive

NOVEMBER 9, 2022

Central bank digital currencies would allow for faster cross-border payments that would “help boost trade within the region and with the rest of the world,” an Equinix executive writes.

Payments Dive

NOVEMBER 9, 2022

Central bank digital currencies would allow for faster cross-border payments that would “help boost trade within the region and with the rest of the world,” an Equinix executive writes.

Abrigo

NOVEMBER 9, 2022

Financial institutions work to meet Q1 2023 CECL deadline A CECL implementation survey by Abrigo found progress by financial instittuions is mixed ahead of the upcoming deadline. . You might also like this: "Beyond CECL: Stress testing, ALM, and financial planning" DOWNLOAD. Takeaway 1 10% of banks and credit unions have completed CECL adoption, according to Abrigo's CECL implementation survey.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

NOVEMBER 9, 2022

Executives for the tech services provider asserted that their pipeline of new business remains healthy despite economic headwinds beating up the rest of the industry.

Gonzobanker

NOVEMBER 9, 2022

New approaches to talent and technology are needed to address changes in the wealth management business model. Wealth management and trust clients are some of the most lasting and profitable relationships a bank can attract, but the banking industry is simply missing the opportunity to realize these businesses’ vast strategic potential. As banks experience rate volatility and future increases in their costs of funds, businesses that drive noninterest income like trust and wealth management will

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

Payments Dive

NOVEMBER 9, 2022

The digital payments company is aiming to cut costs by streamlining operations, reducing capital expenditures and pulling back on vendor contracts.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Dive

NOVEMBER 9, 2022

Odilon Almeida had served as the payments company’s president and CEO since March 2020 and will be succeeded temporarily by board chairman Thomas Warsop.

Banking Exchange

NOVEMBER 9, 2022

Bank to sell 10 sites across three states with the aim of appeasing regulators Compliance Feature Duties Management Mortgage/CRE M&A Mortgage Credit Bank Performance The Economy Community Banking Feature3.

Payments Dive

NOVEMBER 9, 2022

The buy now-pay later company is pulling back on adding talent in some areas, but plunging ahead in others and seeking out talent in lower-cost regions.

CFPB Monitor

NOVEMBER 9, 2022

On November 9, 2022, New York Department of Financial Services (NYDFS) Superintendent Adrienne Harris announced that the NYDFS formally proposed an updated cybersecurity regulation. Although the updates had previously been released in draft form , the formal announcement commences the 60-day comment period. . The proposed regulations would create three different tiers of companies based on their size, operations, and nature of their businesses.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

BankUnderground

NOVEMBER 9, 2022

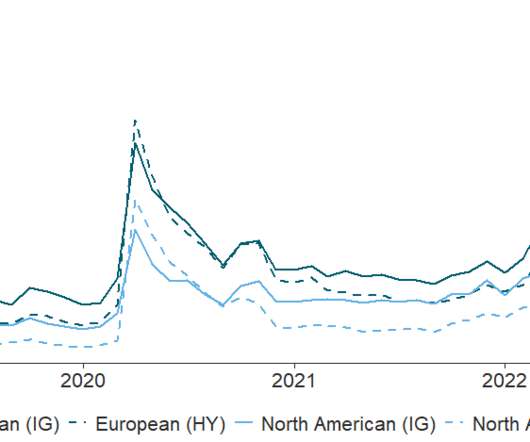

Barbara Jankowiak, Natan Misak and Nicholas Vause. Both financial market participants and regulators have suggested that investor risk appetite has declined since the beginning of the year. This post presents some evidence from credit markets consistent with such developments, and offers two possible explanations. We build on analysis in an earlier post that looked at the relationship between credit default swap (CDS) premiums for insuring against potential losses due to the default of North Ame

TheGuardian

NOVEMBER 9, 2022

Critics say everyday UK consumer spending has funnelled billions to controversial World Cup host since 2010 Some of the UK’s largest listed companies including water and energy giants have handed almost £500m to Qatari state-owned investors this year, raising concerns that blue-chip company profits are supporting the controversial World Cup host. The dividend payouts are the result of the Gulf nation’s investments in a raft of FTSE 100 firms, including Barclays, Shell and utility firm Severn Tre

BankInovation

NOVEMBER 9, 2022

Automation fintech Open Lending’s certified loan volume decreased for the second consecutive quarter in Q3 following six quarters of growth. Total certified loans, or “certs,” decreased 5.3% sequentially and 14.5% year over year to 42,186, according to the fintech’s earnings presentation. Credit unions and banks accounted for 86% of certs while OEM certifications made up 14%.

The Financial Brand

NOVEMBER 9, 2022

This article Will CFPB’s New Data Sharing Rules Alter the Banking Landscape? appeared first on The Financial Brand. The agency's rapid development of data sharing rules among banks, fintechs and other players will have major impact on banking's future. This article Will CFPB’s New Data Sharing Rules Alter the Banking Landscape? appeared first on The Financial Brand.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

BankInovation

NOVEMBER 9, 2022

Risk decisioning platform Provenir is collaborating with mobile data intelligence provider Sekura to enhance fraud protection in the financial services industry. The partnership gives Provenir’s clients — including buy-now-pay-later startup Zilch, Marcus by Goldman Sachs, and SoFi — access to a suite of identity verification, anti-fraud and online authentication services through global mobile operators via […].

BankInovation

NOVEMBER 9, 2022

Embedded finance platform BankiFi announced Tuesday that it is partnering with open banking fintech MX to provide data sharing and account connectivity for businesses within BankiFi’s platform. The partnership will allow small to medium-sized businesses (SMBs) to securely connect their external bank accounts in one place, Keith Riddle, chief executive of the Americas at BankiFi, […].

American Banker

NOVEMBER 9, 2022

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

BankInovation

NOVEMBER 9, 2022

Wealth tech giant Envestnet continued its tech modernization efforts in the third quarter, boosted by new partnerships, product launches and footprint expansion plans. As the Berwyn, Pa.-based company grew, its revenue, users and ultimately expenses in Q3 all inched up year over year: Envestnet’s total revenue inched up 1% to $306.7 million; The tech company’s […].

American Banker

NOVEMBER 9, 2022

The Financial Brand

NOVEMBER 9, 2022

This article Four Ways Branch Self-Service Improves CX and Reduces Costs appeared first on The Financial Brand. Financial institutions that want to add in-branch self-service options can see benefits and improve ROI even with incremental steps. This article Four Ways Branch Self-Service Improves CX and Reduces Costs appeared first on The Financial Brand.

American Banker

NOVEMBER 9, 2022

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

The Emmerich Group

NOVEMBER 9, 2022

I believe people want to work with “the best.” When people truly trust you and you bring value that exceeds your additional pricing, people are willing to bring all their business to you and your bank. At that point, price has little relevance. They know that what you provide is worth the cost. That’s a. Continue Reading. The post How to Move Beyond “Trusted Advisor” Lip Service to Get ALL of their Deposit Business [VIDEO] appeared first on Emmerich Financial.

Digital Growth Institute

NOVEMBER 9, 2022

“What do we need to do as a financial institution? Banking? Yes, check. Loans? Check. Investments? Check. We do all of them, but it's not about making it better. It was about checking the box.” -Mart Vos. Mart Vos , the founder and CEO of Eko Investments , hears the same thing over and over about traditional banking brands. Young people say, “My parents banked there, but it doesn’t offer the products I want.”.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Let's personalize your content