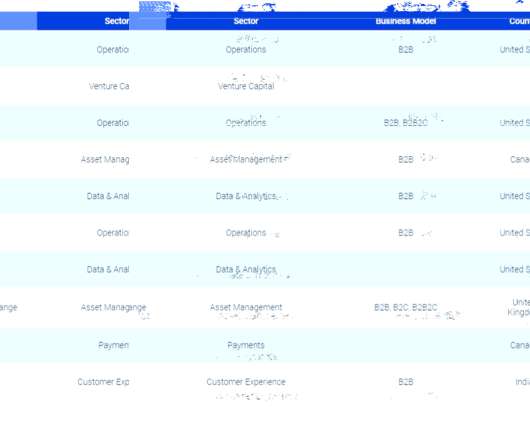

Honeywell jumps into mobile payments battle

Payments Dive

NOVEMBER 1, 2022

The tech conglomerate will couple new payments software with its mobile computers to process transactions anywhere, taking on a pack of rivals already in the market.

Payments Dive

NOVEMBER 1, 2022

The tech conglomerate will couple new payments software with its mobile computers to process transactions anywhere, taking on a pack of rivals already in the market.

Cisco

NOVEMBER 1, 2022

In 2017, New York Department of Financial Services (NYDFS) passed cybersecurity regulation 23 NYCRR 500, requiring all financial services companies to implement multi-factor authentication (MFA). Since its creation, the Cybersecurity Framework has continued to offer updates and guidance on best security practices. In 2021, the NYDFS cybersecurity department explicitly called out MFA weaknesses as one of the most common gaps exploited at financial services companies.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

ATM Marketplace

NOVEMBER 1, 2022

Bitcoin and cryptocurrency can often be difficult to understand. A panel of self-service industry experts discussed the technology in detail and debunked several misconceptions.

CFPB Monitor

NOVEMBER 1, 2022

The CFPB has announced that it will be reopening the comment period on its November 2021 request for public comments to inform its inquiry into large technology companies that offer payment services. In October 2021, the CFPB sent orders to six large technology platforms offering payment services that directed them to provide information to the Bureau about their payments products and services and their collection and use of personal payments data.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

The Paypers

NOVEMBER 1, 2022

Rapyd has conducted a fintech developer survey that reveals their challenges, opportunities, and a wish to collaborate within the developer community.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Bankelele

NOVEMBER 1, 2022

The Competition Authority of Kenya (CAK) had its annual symposium in Nairobi last week with sessions on competition, regulation, policy and consumer protection. On the final day, Director General Wang’ombe Kariuki who is retiring after twelve years had a Q&A talk where he spoke about leading the growth of what was a new institution in […].

The Paypers

NOVEMBER 1, 2022

AccessPay has teamed up with Finastra to simplify traditional corporate banking host-to-host connections and deliver corporate-to-bank connectivity.

BankInovation

NOVEMBER 1, 2022

GM Financial is looking to better personalize the customer experience by removing data silos. The Fort Worth, Texas-based lender collects driving behavior, mileage and location data from its OEM, General Motors, and OnStar, a wholly owned subsidiary of GM, to supplement customer information, Tricia Price, senior vice president of customer experience operations at GM Financial, […].

The Paypers

NOVEMBER 1, 2022

Estonia-based core banking platform Tuum has partnered with SaaS provider Bricknode to augment FIs in deploying digital investment products.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

BankInovation

NOVEMBER 1, 2022

Subprime auto lender Consumer Portfolio Services (CPS) inked a pair of fintech partnerships in September to automate credit decisioning and servicing operations that will allow it to grow at scale without having to hire additional staff. CPS’s partnership with cloud-based finance solutions provider Prodigal will streamline the Irvine, Calif.-based business through a suite of products […].

ABA Community Banking

NOVEMBER 1, 2022

As some banks weigh ditching their holding companies, there are a few considerations for how and why publicly traded banks can file Exchange Act reports directly with their regulatory agencies. The post Filing Exchange Act reports without a holding company appeared first on ABA Banking Journal.

BankInovation

NOVEMBER 1, 2022

In today’s digital world, effectively managing enterprise risk has become more complex and challenging than ever before. The added level of uncertainty due to the acceleration of online banking over the past few years does not make it any easier. As sobering stats continue to demonstrate, cybercrime is growing exponentially each year, as are the […].

The Paypers

NOVEMBER 1, 2022

Indonesia-based Bank Central Asia has planned to migrate its wealth management system to Avaloq , a Switzerland-based provider of digital banking solutions, according to The Asset.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

The Paypers

NOVEMBER 1, 2022

The Digital Services Act has been published in the Official Journal of the European Union, sweeping in a new era in the regulation of digital services.

The Banker

NOVEMBER 1, 2022

The EU regulator’s plans show a commitment to quell greenwashing and make use of data in order to maintain strict oversight of the bloc. James King reports.

The Paypers

NOVEMBER 1, 2022

The Monetary Authority of Singapore (MAS) has completed the first phase of its Central Bank Digital Currency (CBDC) project.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

The Paypers

NOVEMBER 1, 2022

Malta-based Finaro has partnered Estonia-based payment gateway EveryPay to provide a unified SoftPOS card-present payment solution for Greek merchants.

The Paypers

NOVEMBER 1, 2022

UK-based cloud payment technology provider Form3 has secured a EUR 23 mln venture debt facility destined towards the company’s expansion.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

American Banker

NOVEMBER 1, 2022

The Paypers

NOVEMBER 1, 2022

US-based digital identity platform Socure has launched a new account validation solution aimed at FIs, government agencies, and enterprises.

American Banker

NOVEMBER 1, 2022

The Paypers

NOVEMBER 1, 2022

Global cryptocurrency investment app Luno has become a member of the Travel Rule Universal Solution Technology (TRUST) Coinbase network.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Let's personalize your content