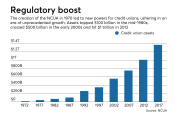

The trend of credit unions

Bankers have long opposed attempts by credit unions to expand their

Introduced by the committee’s chair, Maxine Waters, D-Calif., the bill would allow all federal credit unions to apply to the National Credit Union Administration to expand their field of membership to include underserved communities, including those without a branch within 10 miles.

It would also exempt loans made by credit unions to businesses in those areas from the credit union member business lending cap. Under current law, credit unions are restricted from lending more than 12.25% of total assets to member businesses.

According to the Credit Union National Association, the bill’s member business lending exemption would apply to 2,207 federally insured credit unions that are not already exempt due other designations.

CUNA also points out that there are no provisions in the bill restricting banks from opening operations in those underserved areas.

Still, the bankers are not amused.

In a

According to the NCUA, commercial loans made by credit unions increased $17.3 billion, or 18.4%, to $111.7 billion in the fourth quarter of 2021 from a year earlier.

“What H.R. 7003 seems to provide is the ability for credit unions to expand out-of-market, which contradicts the credit union purpose of serving well-defined local communities and small groups of consumers of modest means,” the letter states. “The legislation also creates a major new loophole in the credit union business lending cap, long one of the most controversial issues in financial services. Bankers remain staunchly opposed to efforts to gut this limitation.”

But credit unions see the proposal primarily as a way to fill a gaping void.

The proposed changes are essential to increasing access to “safe, fair and affordable” financial services in rural communities, communities of color and other underserved places, said Todd Harper, chairman of the NCUA, in a press release.

“They would also advance financial inclusion within our nation’s financial system,” he said.

CUNA said the bill would give communities, small businesses and individuals who have lost access to affordable financial services — or perhaps have never had them — easier access to federal credit unions.

According to CUNA research, more than 750 census tracts in the U.S. are financial deserts, and a net 7,800+ bank branches closed between January 2005 and March 2021. During the same period, more than 1,400 net credit union branches opened.

But the business lending component is the key to the legislation, said Patrick Keefe, a credit union industry observer, former industry advocate and editor of the

Any relief from the 12.25% cap would be a big win for credit unions, he said.

“That’s potentially a big shift for credit unions, who are looking for new revenue sources whenever possible,” he said. “The exemption means they could start making more MBLs without constriction.”

Jason Stverak, CUNA’s deputy chief advocacy officer for federal government affairs, said the trade group is working with lawmakers on both sides of the aisle to build consensus around the legislation.

“Whether the policy advances on its own or along with other legislation is up to House lawmakers, but we’re optimistic we’ll see movement this Congress,” Stverak said.

But according to Keefe, the outlook for the legislation is "challenging, to say the least,” he said. The bill faces a big uphill climb and will likely have to be brought up again in the next Congress.

He pointed to CUNA’s own

“Yeah, that’s all: just opposition from the banking industry. No big deal,” Keefe joked. “Except, it is. Banks clearly see this as an expansion of credit union powers — providing more services to people who aren’t now eligible for membership — and credit union commercial lending, which banks are out to impede, vigorously.”

It will take a pretty big push by the credit unions to get the legislation enacted, according to Keefe, and he is not convinced that most credit unions really care about more business lending authority. “Even though they probably should,” he said.