Chip shortage drives up card costs

Payments Dive

MAY 26, 2022

Russia's invasion of Ukraine is affecting card chip prices because Ukraine is home to two companies that produce half of the world’s neon supply, a key ingredient in chips.

Payments Dive

MAY 26, 2022

Russia's invasion of Ukraine is affecting card chip prices because Ukraine is home to two companies that produce half of the world’s neon supply, a key ingredient in chips.

Accenture

MAY 26, 2022

Public pledges by HSBC, ING and UBS to curb their funding of fossil fuel production are welcome signs that the shift to sustainable banking is gathering speed. These banks, among others, are using their allocation of credit to encourage sustainable business practices. They recognize that sustainable lending is critical for the well-being of their own….

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

MAY 26, 2022

With Sunbit, Weave can now add BNPL to its other services that help small businesses collect customers’ payments, including text to pay, digital wallets, wireless terminals and credit-card on file.

Bobsguide

MAY 26, 2022

Generation Life – a leading life insurance company that’s been providing Australians with tax-effective investment solutions for over 18 years – has launched its innovative new lifetime income solution, known as Generation Life LifeIncome, on GBST’s cloud-based wealth administration platform, Composer. Available exclusively through financial advisers, Generation Life’s new and exciting solution, an investment-linked lifetime annuity that pays an income for life – paves the road for much needed p

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

Payments Dive

MAY 26, 2022

The cryptocurrency market downturn has led marketing spend in this sector to plunge, especially after unprecedented highs seen during Super Bowl LVI.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Dive

MAY 26, 2022

The bureau walked back its no-action letter and sandbox policies in favor of "incubation events" meant to troubleshoot barriers to innovation and help customers switch providers more easily.

BankInovation

MAY 26, 2022

NEW YORK CITY — Citi is blazing a path toward comprehensive AI-based credit management. One of the nation’s largest banks, $2.3 trillion Citi has leveraged AI for everything from document handling and back-office process automation to sanctions and capital management. Now, Citi will strengthen its AI capabilities for consumer credit management and customer experience, sorting […].

CFPB Monitor

MAY 26, 2022

AG Weiser discusses the areas of consumer financial services that are a current focus of his office’s efforts. After discussing the role of the newly-created Office of Financial Empowerment in addressing the needs of unbanked consumers, AG Weiser discusses his office’s activities concerning deceptive fees (including the types of fees of primary concern and the requirements of Colorado’s new automatic renewal law), robocalls, and student loans.

BankInovation

MAY 26, 2022

Bank of Montreal will leverage a proprietary, cloud-based, risk management analytics solution to forecast loan loss scenarios faster and with better cost-efficiency. BMO Chief Executive Darryl White referenced the system during the bank's earnings call Wednesday. “We continue to modernize our technology through cloud,” White said. “For example, we're converting to a proprietary platform […].

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

CFPB Monitor

MAY 26, 2022

The CFPB has sent letters to the chief executive officers of five major credit card issuers regarding their companies’ payment furnishing practices. In the letters, the CFPB cites a 2020 report in which it provided data showing a decline in the share of credit card tradelines containing actual payment data since 2012. The CFPB states in the letters that based on easily accessible credit report information, the CFPB understands that each of the companies to which a letter was sent currently does

BankInovation

MAY 26, 2022

Diversity, equity and inclusion (DEI) efforts at financial institutions need to go beyond a checkmark on a list of to-dos to become part of a lender’s DNA. At $1.94 trillion Wells Fargo, “from leadership, I think we have the commitment, but I think we all are, admittedly, still in that check-the-box phase,” Nathan Bricklin, head […].

William Mills

MAY 26, 2022

There is no better time than the present for credit unions to establish their presence in the virtual world and position themselves above the competition. As society continues to embrace all things digital, the metaverse has emerged as a promising digital avenue, providing a network that merges physical and virtual worlds and is intertwined with social connection.

BankInovation

MAY 26, 2022

Broadcom Inc. agreed to buy cloud-computing company VMware Inc. for about $61 billion in one of the largest technology deals of all time, turning the chipmaker into a bigger force in software. VMware shareholders can choose to receive either $142.50 in cash or 0.2520 shares of Broadcom stock for each VMware share, according to a […].

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

The Paypers

MAY 26, 2022

Global payments processor and card issuer Mastercard and ecommerce payments service provider HyperPay have announced a partnership to expand digital payments in the MENA region.

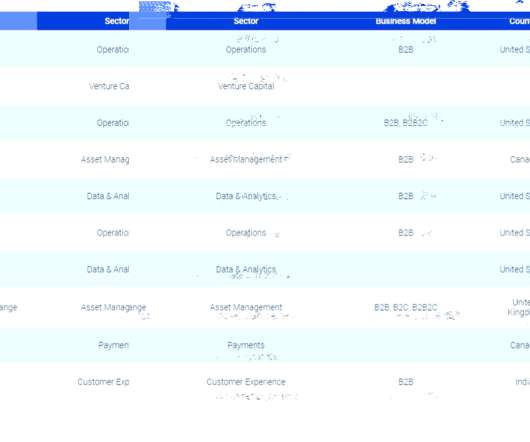

CB Insights

MAY 26, 2022

Paddle , a provider of payments infrastructure for SaaS companies, has acquired ProfitWell , a subscription analytics startup, for $200M in cash and equity. <span data-sheets-value='{"1":2,"2":"<div class="cbi-cta-shortcode-wrapper"><div class="cbi-cta-shortcode-content"></div><div class="cbi-cta-shortcode-forms" ><div class="cta has-desktop"><div class="cta-desktop center-copy ">

The Paypers

MAY 26, 2022

Following the decision of Visa and Mastercard in early March 2022, followed by Chinese UnionCard, to back away from its territory, Russia has pushed the adoption of the homemade MIR cards, according to EWDN.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

The Paypers

MAY 26, 2022

France-based security solution provider Verimatrix has announced that its Verimatrix Code Shield solution has been deployed by software-based payment technology company Alcineo.

American Banker

MAY 26, 2022

The Paypers

MAY 26, 2022

Social media platform Twitter has failed to protect the privacy of users’ data for six years and has been ruled by the Justice Department and the Federal Trade Commission in the US to pay USD 150 million in penalties.

American Banker

MAY 26, 2022

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

The Paypers

MAY 26, 2022

US-based insurance payments network One Inc has property carrier Central Insurance has selected its ClaimsPay solution to digitise claim payments.

American Banker

MAY 26, 2022

The Paypers

MAY 26, 2022

UK-based digital bank Revolut has announced upgrading its business accounts with new spend management capabilities.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Let's personalize your content