6 payments trends to watch in 2023

Payments Dive

JANUARY 10, 2023

FedNow, embedded payments, deal-making, cybersecurity and more mature BNPL will be dominant themes, among others, in the industry this year.

Payments Dive

JANUARY 10, 2023

FedNow, embedded payments, deal-making, cybersecurity and more mature BNPL will be dominant themes, among others, in the industry this year.

South State Correspondent

JANUARY 10, 2023

Examining Bond Portfolio Trends: Fourth Quarter 2022. Beginning in May 2012, we started tracking portfolio trends of our bond accounting customers here at SouthState|DuncanWilliams. At present, we account for over 130 client portfolios with a combined book value of $13.96 billion (not including SouthState Bank), or $107 million on average per portfolio.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

JANUARY 10, 2023

The digital payments giant disclosed late Monday that its chief accounting officer has resigned to take a job with another company.

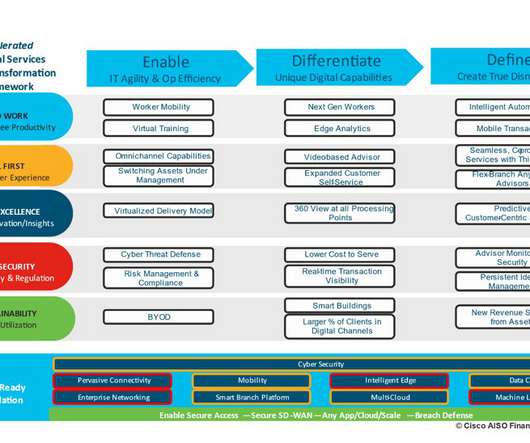

Cisco

JANUARY 10, 2023

As a change agent serving the financial services industry for over 20 years, it is a great privilege to collaborate with Bank, Insurance, and Wealth Management institutions to devise and execute digital transformation strategy, solve complex business problems, and leverage technology to strengthen business results. Ending a chaotic 2022 with the Federal Reserve in their December meeting raising interest rates to control inflation another 50 basis points following four consecutive 75 basis point

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

ATM Marketplace

JANUARY 10, 2023

We have now entered into 2023, and it's time to look ahead to see what's on the horizon for branches, self-service and overall banking trends this year.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

William Mills

JANUARY 10, 2023

Do “main characters” only exist within the pages of a book or the movie screens we watch? A trend devised by Gen Z members attests otherwise. Originating on TikTok during the height of the pandemic, the main character trend typically refers to an individual’s change in perspective to gain confidence in the unique elements of their personal identity.

BankInovation

JANUARY 10, 2023

Synthetic identity fraud remains a constant challenge for banks, with a growing number of fraudsters attacking demand deposit accounts since the onset of the COVID-19 pandemic. In fact, one in three accounts within fintech and retail banking are synthetic, Mike Cook, vice president of commercialization – fraud solutions at identify verification fintech Socure, tells Bank […].

FICO

JANUARY 10, 2023

Home. Blog. FICO. Top 5 Fraud Posts for 2022: Scams, Contactless and Money Mules. In a year that saw the word "scamdemic" coined, scams such as authorised push payment fraud were top of mind, along with various other fraud schemes. FICO Admin. Tue, 07/02/2019 - 02:45. by FICO. expand_less Back To Top. Tue, 01/10/2023 - 11:30. Few things change faster in the financial services space than fraud trends.

BankInovation

JANUARY 10, 2023

Lauren Kenney, senior vice president of payment services at U.S. Bank, will join the panel “Strategies for automating real-time payment processes” at the Bank Automation Summit U.S. 2023 on Friday, March 3, at 9:50 a.m. ET. View the full agenda for Bank Automation Summit U.S. 2023 here. Kenney will discuss how to select the right […].

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

The Paypers

JANUARY 10, 2023

Germany’s Federal Financial Supervisory Authority ( BaFin ) has issued a warning about a new crypto malware named Godfather.

ATM Marketplace

JANUARY 10, 2023

Explore how ChargeItSpot deploys their kiosks in stores and other retail venues with their own Wireless WAN network and LTE connectivity.

The Paypers

JANUARY 10, 2023

Payment solutions provider BPC has announced the extension of the partnership with Bahrain-based IPS , to boost the use of its SmartVisa platform.

American Banker

JANUARY 10, 2023

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

The Paypers

JANUARY 10, 2023

The Metropolitan Bank Holding Corp, the holding company for Metropolitan Commercial Bank , has announced the shutting down of its crypto-asset-related vertical, according to Coin Telegraph.

The Banker

JANUARY 10, 2023

Ongoing research finds “a feeling of trust in a country’s population is a vital component in a bank’s decision to lend to a government”. Liz Lumley reports.

The Paypers

JANUARY 10, 2023

Santander CIB , Allianz Trade , and Two have partnered to develop a new business-to-business (B2B) Buy Now, Pay Later (BNPL) solution dedicated to large multinational corporates.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

The Paypers

JANUARY 10, 2023

British TSB Bank officials have warned that the fraud refund rules proposed by the Payment Systems Regulator to come into effect in 2023 will exclude a significant part of APP fraud victims.

The Paypers

JANUARY 10, 2023

Identity authentication solutions provider authID has partnered tax data and IRS account monitoring provider Tax Status to launch its suite of services for the latter’s enterprise partners.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

The Paypers

JANUARY 10, 2023

US-based secure access service edge (SASE) provider Netskope has raised USD 401 million in an oversubscribed funding round.

American Banker

JANUARY 10, 2023

The Paypers

JANUARY 10, 2023

US-based ecommerce software company BigCommerce has partnered Microsoft Advertising to launch Microsoft Ads and Listings for merchants on the BigCommerce Marketplace.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Let's personalize your content