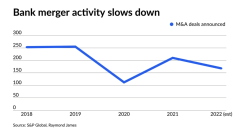

For many banks, investment banking divisions offer both the prestige of mergers and acquisitions and the steady fees that result from advising on and underwriting deals. But the environment for deals has gotten less favorable this year: the Fed raised interest rates sharply after a long period of near-zero rates, the stock market fell, and the Biden administration signaled its regulators would take a harder look at many proposed transactions.

Scroll through for a review of how investment banking fared this year.