Treasury Yields Drift Higher Ahead of Jackson Hole

South State Correspondent

AUGUST 24, 2022

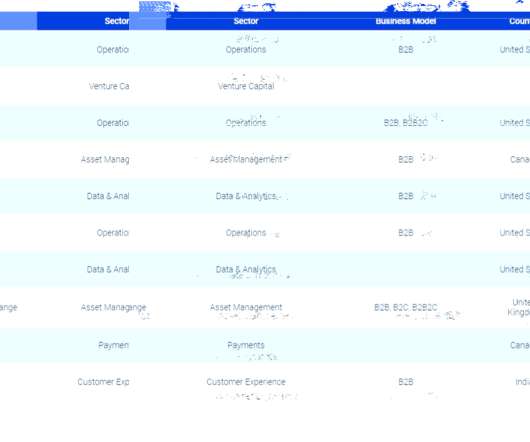

Treasury Yields Drift Higher Ahead of Jackson Hole. Treasury yields are drifting higher this morning, but the moves are in range which is not surprising with Fed Chair Powell’s Jackson Hole appearance approaching this Friday. The 10yr Treasury yield is back above 3.00% and is currently at 3.09% while the 2yr-10yr spread is -27bps. This drift is likely to persist until we get past the Jackson Hole event on Friday morning.

Let's personalize your content