Payments deals may climb in 2023

Payments Dive

JANUARY 4, 2023

While the number of deals in the payments industry declined 14% last year, and even more by value, there are reasons to believe 2023 will be more active.

Payments Dive

JANUARY 4, 2023

While the number of deals in the payments industry declined 14% last year, and even more by value, there are reasons to believe 2023 will be more active.

South State Correspondent

JANUARY 4, 2023

A potential economic slowdown, slower rate rises, an inverted yield curve, and deposit stress likely make 2023 a trying year compared to 2022. Banks will need to balance these short-term challenges with longer-term strategic goals. For any banker looking for clarity, we present five New Year’s resolutions, no matter your size, that provide a roadmap to accomplish both the short and long-term objectives of a top-performing bank.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

JANUARY 4, 2023

The regulators didn't go so far as to create new rules around bank-crypto partnerships, but said they're "continuing to assess" if — and how — such tie-ups can proceed safely.

Abrigo

JANUARY 4, 2023

Guidance for banks on the lookout for crypto scams and fraud The turbulent cryptocurrency scene should put bankers on high alert. The FTC's top ten scams to watch for can help. . You might also like this whitepaper, "Understanding cryptocurrency." DOWNLOAD WHITEPAPER. Takeaway 1 Cryptocurrencies are the newest and most popular field in potential financial gains through fraud.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

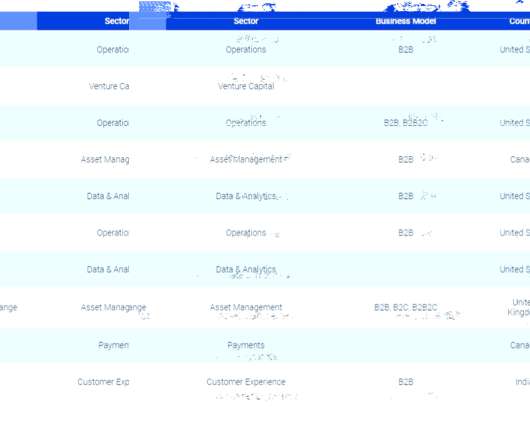

CB Insights

JANUARY 4, 2023

Inflation. Interest rates. Supply chains. Market volatility. Projected growth. After 2022’s countless shake-ups, many are hoping that the new year will usher in a renewed sense of dynamism — and maybe even optimism — in the tech world as “the new normal” shifts once again. If nothing else, the coming year will certainly prove that nothing in tech stays the same for long.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

BankInovation

JANUARY 4, 2023

Financial institutions continue to upgrade their mobile offerings as consumer expectations require self-service capabilities. For example, Citizens Financial Group and Fifth Third Bank at the end of last year announced plans to launch new mobile apps amid rising digital usership. The following federal credit unions, too, have switched mobile banking providers, according to an FI […].

The Paypers

JANUARY 4, 2023

Identity tech company IDEMIA has announced that the Australian Department of Home Affairs has installed its technology for border control in eight international airports.

BankInovation

JANUARY 4, 2023

Core provider Fiserv is teaming with digital wallet company Wedge to offer financial institutions access to a host of payment options. The partnership will allow customers to use programmable payments that follow real-time rules to discover, calculate and confirm required conditions so that a payment can be automatically executed without human intervention, Fiserv said in […].

The Paypers

JANUARY 4, 2023

India-based private sector bank HDFC Bank has announced a partnership with Microsoft to further its digital transformation journey by leveraging Microsoft Azure.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

FICO

JANUARY 4, 2023

Home. Blog. FICO. Despite Rapid Adoption of Digital Channels, Customer Trust Lags. FICO global survey finds customers want better fraud protection and more security from their digital banking channels. FICO Admin. Tue, 07/02/2019 - 02:45. by Sarah Rutherford. expand_less Back To Top. Wed, 01/04/2023 - 14:05. Though adoption of digital banking and e-commerce has grown substantially in the past three years, it isn't the case that all consumers prefer to use digital means, namely web portals or mob

The Paypers

JANUARY 4, 2023

The Federal Reserve, FDIC and OCC have released a joint statement in order to warn banks about the risks associated with crypto assets.

The Paypers

JANUARY 4, 2023

IMTF has acquired the Siron anti-money laundering and compliance solutions developed by FICO to expand its AML and compliance portfolio.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

The Paypers

JANUARY 4, 2023

Pharmacies in Ukraine are embracing digital payments amid the ongoing war, with ANC Pharmacy allowing payments in cryptocurrencies like Bitcoin, through Binance.

The Financial Brand

JANUARY 4, 2023

This article Digital Wallet Role Eyed as Banks Risk Lost Payments Income appeared first on The Financial Brand. The digital wallets that consumers favor come from big tech firms like Apple and fintechs like PayPal. How can banks get into the game? This article Digital Wallet Role Eyed as Banks Risk Lost Payments Income appeared first on The Financial Brand.

The Paypers

JANUARY 4, 2023

The Maestro feature for debit cards will expire in July 2023 in Germany.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

The Paypers

JANUARY 4, 2023

The Saudi Central Bank (SAMA) has rolled out the Open Banking Lab which follows the Open Banking Framework issued by SAMA in November 2022 , according to Fintech Finance News.

The Paypers

JANUARY 4, 2023

GoLogiq a US-based global provider of fintech and consumer data analytics, has signed a definitive share exchange agreement with GammaRey , merging the privately-held fintech ecosystem.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

The Paypers

JANUARY 4, 2023

UAE-based platform bank Wio Bank has partnered First Abu Dhabi Bank (FAB) to offer cash and cheque services to Wio Business customers through FAB’s ATM and CDM network.

American Banker

JANUARY 4, 2023

The Paypers

JANUARY 4, 2023

actyv.ai has partnered with RATNAAFIN , an NBFC which is a part of the Ratnamani Metals Group, to improve its embedded offerings.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Let's personalize your content