PayPal to cut 7% of its workforce

Payments Dive

JANUARY 31, 2023

The digital payments pioneer said it’s cutting 2,000 employees as the company seeks to adapt to a new, more competitive environment.

Payments Dive

JANUARY 31, 2023

The digital payments pioneer said it’s cutting 2,000 employees as the company seeks to adapt to a new, more competitive environment.

Independent Banker

JANUARY 31, 2023

Photo by Chris Williams [ICBA LIVE is] an opportunity to continue training up the next generation, so I would encourage community bank leaders to join us and bring your rising community continuators with you. The passion I have for community banking was born at ICBA LIVE 2011, which was my first ICBA convention as an adult. I thought I already loved community banking, but I didn’t realize how much until then.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

JANUARY 31, 2023

Simon Khalaf, who takes the top job Tuesday, is counting on new embedded offerings to help expand the company’s services for corporate clients.

Independent Banker

JANUARY 31, 2023

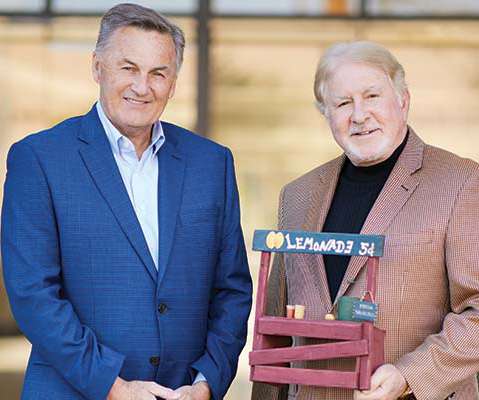

Inspired by the entrepreneurship of lemonade stands, Scottsdale Community Bank created a microloan program. Photo by Brandon Sullivan De novo Scottsdale Community Bank set out to provide microloans to small and mid-size businesses, family organizations and nonprofits—a project that was inspired by the humble lemonade stand. By William Atkinson Name: Scottsdale Community Bank Assets: $28 million Location: Scottsdale, Ariz.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

Payments Dive

JANUARY 31, 2023

Customer appetite for Jack Henry's services is likely to attract analysts' attention in the upcoming earnings report.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Banking Exchange

JANUARY 31, 2023

90% of businesses worldwide are small and medium enterprises, or SMEs Community Banking Commercial Feature3 Feature Business Credit The Economy Lines of Business Small Business

Independent Banker

JANUARY 31, 2023

Photo by Chris Williams When we assemble at LIVE, it’s about coming together to ignite the passion for community banking on behalf of our communities in a way that moves the industry forward. The Hawaiian word for family is ‘ohana, and as we prepare to head to Honolulu for ICBA LIVE next month, I’m struck by how much that word describes this community.

ATM Marketplace

JANUARY 31, 2023

2023 will be a big year for the Bank Customer Experience Summit, which gathers bankers, self-service vendors and fintechs to network and discuss banking trends. This year, the summit will be combined with the ICX Summit from Sept. 12 to 13 in Charlotte, North Carolina.

Independent Banker

JANUARY 31, 2023

Photo by Rido/Adobe Maximizing each step in the innovation journey, including the fintech evaluation process, will set you on the right path to a fruitful fintech partnership. By Charles Potts, ICBA When it comes to innovation, understanding how we do it may be even more important than why. With technology upgrades and customer experience consistently ranking as chief priorities for community banks, there’s no question that innovation serves as a strategic imperative.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

Banking Exchange

JANUARY 31, 2023

Banks must first look at how changing consumer payment preferences are impacting market dynamics Payments Feature Feature3 Consumer Credit Bank Performance Financial Trends Lines of Business Customers Performance

Independent Banker

JANUARY 31, 2023

Photo by Nina Lawrenson/peopleimages.com/Adobe Here are 12 ways to light up your February and find your focus. By Lindsay LaNore, ICBA The nights are still long and spring hasn’t yet sprung, so don’t blame yourself if you’re feeling sluggish. But how do you keep productivity up when your workload is showing no signs of hibernating? The theme for next month’s ICBA LIVE is “Light the Fire.

CFPB Monitor

JANUARY 31, 2023

The FDIC has announced that it is extending by 45 days the comment period for proposed changes to its signage and advertising rule. Several banking trade groups sent a letter to the FDIC requesting the 45-day extension. Originally set for February 21, the comment deadline is extended to April 7, 2023.

Independent Banker

JANUARY 31, 2023

Digital media gives community bankers a platform for advocacy, and ICBA’s Virtual Advocacy Primer details how you can put it to work. How can a community banker best connect with a member of Congress? With the growing number of virtual options—whether it’s email, social media or video calling—community bankers can bridge the gap and advocate for the industry’s best interests, whether that’s cannabis-related business financing, small and rural business credit, or credit unions’ unfair advantage.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

The Paypers

JANUARY 31, 2023

B2B financial marketplace Fiserv has been granted a Major Payment Institution (MPI) licence by the Monetary Authority of Singapore (MAS) for its local operating entity.

Independent Banker

JANUARY 31, 2023

Illustration by Maïté Franchi With educational sessions on hot‑button issues, inspirational speakers and beneficial networking opportunities, ICBA LIVE is the greatest community banking event in the country. Here’s a sneak peek of what to expect from the event, held this year from March 12–16 in Honolulu. 3 ways ICBA LIVE will support your community bank’s 2023 plans Register today To see the full ICBA LIVE agenda, including education sessions, or to register, visit icba.org/live Each year, ICBA

The Paypers

JANUARY 31, 2023

Canada-based company Trulioo has launched a new global identity verification platform, to help clients archive secure regulatory compliance and optimise growth.

Independent Banker

JANUARY 31, 2023

Photo by Zutik by Andoni/Stocksy Data analysis can illuminate patterns and trends in your customers’ transactions. Community bankers and industry experts share how to best put this data to use. By Colleen Morrison Data is the new currency for Big Tech, business, banking and beyond. “All data creates a competitive advantage. Google is not in the search engine business for the money; they are in it for the data,” says Tina Giorgio, president and CEO of ICBA Bancard.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

ATM Marketplace

JANUARY 31, 2023

The implementation of a cybersecurity strategy based on the Lookwise Device Manager (LDM) solution, applies a comprehensive set of protection technologies, making it possible to secure key devices without interrupting operations or customer access to ATM services.

Independent Banker

JANUARY 31, 2023

Photo by Chris Williams As we enter a new chapter and start a new financial statement cycle, know that ICBA will be there to support you with tools, resources and advocacy efforts. The beginning of a new year feels like a fresh start, a new chapter in our stories. We have a blank page on which we can write our narrative over the course of the year, with new milestones filling the pages ahead.

BankInovation

JANUARY 31, 2023

Chris Tremont, chief digital officer at Grasshopper Bank, will join the panel discussion “Automation and the pursuit of efficiency: A frank discussion on cost/benefit” at the Bank Automation Summit U.S. 2023 on March 2, at 2:15 p.m. ET. View the full agenda for Bank Automation Summit U.S. 2023 here.

Tomorrow's Transactions

JANUARY 31, 2023

The Truth about Open Payments Towards the end of last year, Mobility Payments held a spirited webinar to debate the pros and cons of Open-Loop Payments in transit, with panelists from Europe, Australia and Asia. At the end the moderators stated that they plan to hold a second session, as they only covered two of… Continue reading The truth about Open Payments The post The truth about Open Payments first appeared on Consult Hyperion.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

BankInovation

JANUARY 31, 2023

Americans are leaning on the use of digital banking and its associated tools to help feel financially resilient amid economic uncertainty. Digital adoption has continued to grow, and the 46% of Americans who consider themselves financial experts rely more on digital tools now than they did in 2021, according to KeyBank’s “2023 Financial Mobility Survey.

BankInovation

JANUARY 31, 2023

Long considered a nuisance, distributed-denial-of-service attacks, or DDoS, are a growing problem for banks and other financial businesses, according to a new report.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Let's personalize your content