Fintech funding: Crypto asset-tracking, credit-building firms reach unicorn status

BankInovation

JANUARY 28, 2022

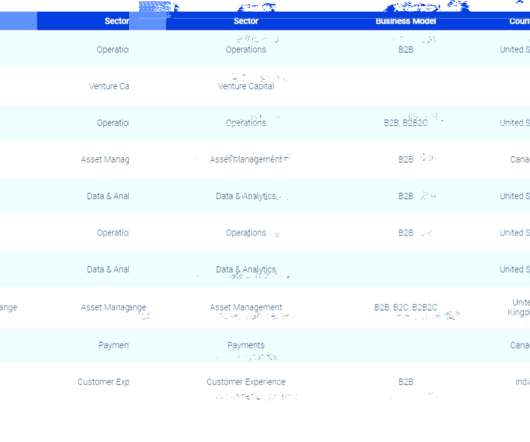

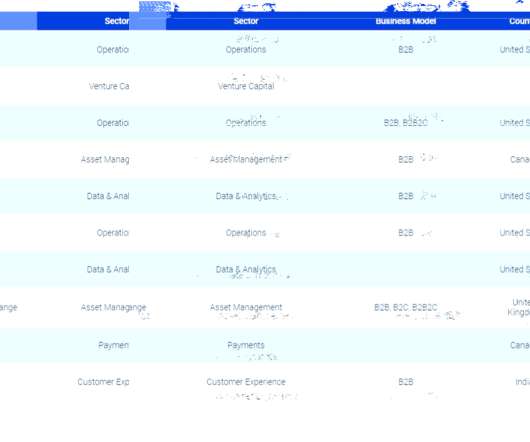

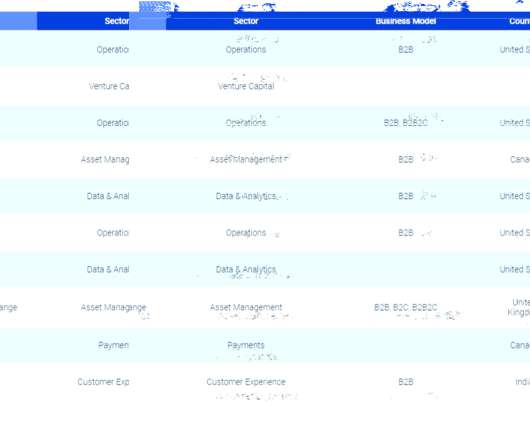

Topping the news for fintech funding this week are two unicorns: a California cryptocurrency asset-tracking platform provider and a New York credit-building platform provider, both of which reached valuations of more than $1 billion. And, two London-based fintechs, one in crypto business trading services and the other in investment management, had nearly identical $59 million […].

Let's personalize your content