Buy now/pay lenders lenders focus on niches hit hard by inflation

American Banker

FEBRUARY 8, 2023

South State Correspondent

FEBRUARY 8, 2023

After last week’s FOMC rate increase of 25 basis points, the yield curve is more inverted than at any time in the previous 30 years. The current yield curve presents various challenges for community bankers for revenue generation and risk management. In this article, we will outline the significance of the yield curve shape and what it may portend for community banks.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

FEBRUARY 8, 2023

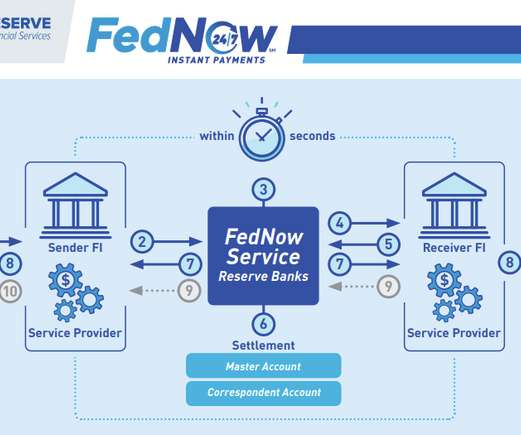

In July, the company expects to become the first payments processor to launch the Federal Reserve’s new real-time service.

Gonzobanker

FEBRUARY 8, 2023

Fintech startups looking for funding in 2023 are finding that it isn’t as easy as it was a few years ago. According to CB Insights, fintech funding in the U.S. totaled $3.9 billion in Q4 2022, down 79% from Q4 2021. The total number of deals funded dropped from 423 in Q4 2021 to 342 in Q4 2022, representing a 73% decline in the average funding amount per raise from $43 million down to $11.4 million.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

Payments Dive

FEBRUARY 8, 2023

The new top executive, Ryan McInerney, and other executives at the card network company also received multi-million-dollar stock awards.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

CB Insights

FEBRUARY 8, 2023

Insurtech investment activity in 2022 pulled back sharply after a record-breaking year in 2021. Annual funding fell 53% from $17.8B to $8.4B, while deals fell 17% from 697 to 579. While a steep fall compared to the previous year, the annual totals for 2022 were not far off those for 2020. However, investment activity has continued to slow. Q4’22 funding only reached $1B — the lowest quarterly total since Q2’18 — and deals were down 28% QoQ at just 106.

ABA Community Banking

FEBRUARY 8, 2023

Treasury plans to convene an interagency cloud services steering committee to develop closer cooperation among U.S. regulators and develop best practices for cloud adoption frameworks. The post Treasury report: ‘Significant’ challenges remain to banks’ optimal cloud services use appeared first on ABA Banking Journal.

The Paypers

FEBRUARY 8, 2023

Switzerland-based cybersecurity, AI and IoT company WISeKey has announced that its semiconductors, NFTs, post-quantum and blockchain solutions are used to secure smart cities.

BankInovation

FEBRUARY 8, 2023

Apple Inc. has expanded an internal test of its upcoming “buy now, pay later” service to the company’s thousands of retail employees, a sign the long-awaited feature is finally nearing a public release.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

The Paypers

FEBRUARY 8, 2023

Oracle , a US-based cloud technology company, has launched Oracle Banking Cloud Services, a new suite of componentised, composable cloud native services.

BankInovation

FEBRUARY 8, 2023

U.S. Bank has rolled out automated direct deposit switching capabilities, allowing customers to connect or switch their payroll deposit account in near-real time. The feature is available to U.S.

The Paypers

FEBRUARY 8, 2023

The Bank of England and HM Treasury have published a new paper that explores the introduction of a central bank digital currency.

Image Works Direct

FEBRUARY 8, 2023

The changing of a calendar year is a great time to reexamine and refresh your marketing approaches, so our team hosted a webinar focused on that exact topic.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

The Paypers

FEBRUARY 8, 2023

Global company activating in the field of direct bank payments, GoCardless , has recently launched GoCardless Embed , an integration for third party payment providers who can now access its global bank payment network.

The Paypers

FEBRUARY 8, 2023

Germany-based DHL eCommerce Solutions , the logistics specialist of DHL has partnered logistics arm of Alibaba Group, Cainiao Network , to improve out-of-home (OOH) delivery in Poland.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

The Paypers

FEBRUARY 8, 2023

Global payments orchestration platform APEXX has partnered with B2B car rental software provider CarTrawler to augment the latter’s legacy payment software system.

The Paypers

FEBRUARY 8, 2023

Sweden-based fintech Trustly has partnered with Cross River and online gaming operator PointsBet to provide players Instant Payouts across the US.

American Banker

FEBRUARY 8, 2023

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

The Paypers

FEBRUARY 8, 2023

UK-based digital lending marketplace Freedom Finance has added lending products from the likes Santander , ASDA Money , Admiral , and others.

The Paypers

FEBRUARY 8, 2023

Payment service provider and regtech platform Banxa has partnered MetaMask in order to simplify cryptocurrency purchasing.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Let's personalize your content