Consumers tap BNPL for larger purchases

Payments Dive

SEPTEMBER 30, 2022

Marqeta's report, which showed U.S. buy now-pay later use has climbed since last year, also points to consumers acquiring more credit cards.

Payments Dive

SEPTEMBER 30, 2022

Marqeta's report, which showed U.S. buy now-pay later use has climbed since last year, also points to consumers acquiring more credit cards.

SWBC's LenderHub

SEPTEMBER 30, 2022

One of the most common ways your borrowers can suffer significant loss of income is through a disability. While many disabilities cause only temporary loss of income, the average long-term disability lasts 31.2 months.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

SEPTEMBER 30, 2022

PayPal alum Robert Mitchell will take the remittance platform’s financial helm as it looks to foster further growth after reaching profitability during the first half of 2022.

TheGuardian

SEPTEMBER 30, 2022

Three homebuyers on how they have been affected by the collapsing mortgage market Frances, 30, works in the healthcare sector and has been trying to sell her house in Cambridge in order to buy a bigger home in Bristol. In the past couple of weeks the chain for her house sale has collapsed twice, forcing her and her husband into a third attempt to upsize.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

Payments Dive

SEPTEMBER 30, 2022

CEOs of payments-related companies shared their thoughts on what consumers and merchants want when it comes to checkout and payments this holiday season.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

TheGuardian

SEPTEMBER 30, 2022

Lenders began pulling products on Monday as they struggled to price products amid financial uncertainty Kwasi Kwarteng’s mini-budget: key points at a glance More than 40% of available mortgages have been withdrawn from the market since the UK government announced its mini-budget on Friday , figures show. Lenders began suspending products on Monday as they struggled to price them amid the uncertainty on financial markets – and the volatility and number of offers being removed have snowballed this

CFPB Monitor

SEPTEMBER 30, 2022

In a new blog post , “Buy now, pay later – and comply with the FTC Act immediately,” the FTC reminds nonbank participants in the buy-now-pay-later (BNPL) market, such as retailers, BNPL providers, marketers, and debt collectors, that they can be liable for violations of Section 5 of the FTC Act based on the information they communicate to consumers and how they communicate such information.

TheGuardian

SEPTEMBER 30, 2022

Your one-stop shop for all the jargon you’ve been reading since Kwasi Kwarteng’s mini-budget Kwasi Kwarteng’s mini-budget has gone down badly in the financial markets. Mortgage rates have risen and the Bank of England has been forced to step in to halt a run on pension funds since the chancellor announced his policies on Friday. The picture is complex and fast-moving, and the jargon used to explain it leaves much of the public feeling more confused.

CFPB Monitor

SEPTEMBER 30, 2022

The U.S. Chamber of Commerce, joined by six other trade groups, filed a lawsuit yesterday in a Texas federal district court against the CFPB challenging the CFPB’s recent update to the Unfair, Deceptive, or Abusive Acts or Practices (UDAAP) section of its examination manual to include discrimination. The other plaintiffs are American Bankers Association, Consumer Bankers Association, Independent Bankers Association of Texas, Longview Chamber of Commerce, Texas Association of Business, and Texas

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

BankUnderground

SEPTEMBER 30, 2022

Benjamin King and Jamie Semark. Open-ended funds (OEFs) offer daily redemptions to investors, often while holding illiquid assets that take longer to sell. There is evidence that this mismatch creates an incentive for investors to redeem ahead of others, which could lead to large redemptions from OEFs and asset price falls. Some research has suggested that ‘ swing pricing ’ can help to moderate these redemptions, but until now, no-one has considered the impact of its use on the wider economy.

Bobsguide

SEPTEMBER 30, 2022

GFT helps French mutual insurer Macif migrate their largest business line to Guidewire InsuranceSuite on the cloud. Over 180,000 quotations, 70,000 contracts, and 300 claims submitted in the first three weeks. French mutual insurer Macif is now using Europe’s leading core insurance platform on the cloud. Macif has deployed Guidewire InsuranceSuite for their largest business line, Mobility, on Guidewire Cloud.

The Paypers

SEPTEMBER 30, 2022

Pay.UK and fifteen of the UK’s banks and building societies have decided to shut down the Paym payments system due to diminishing transaction volumes.

BankInovation

SEPTEMBER 30, 2022

Open banking platform BankiFi has named Danny Piangerelli its chief technology officer. BankiFi launched in North America in June and is looking to digitize and automate processes for small businesses, Piangerelli told Bank Automation News. “Small businesses don't care about the minutiae of accounting, they care about getting paid and understanding where their money is, […].

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

The Paypers

SEPTEMBER 30, 2022

Chainlink and SWIFT have announced a proof-of-concept that will allow the international bank cooperative to transfer cryptocurrencies across most blockchains.

BankInovation

SEPTEMBER 30, 2022

Teslar Software is preparing to launch a new indirect lending solution for community banks. The Springdale, Ark.-based software-as-a-solution (SaaS) platform showcased its new product, which automates and digitizes the underwriting process, during the recent FinovateFall 2022 in New York City. “The goal is under 30 minutes that banker underwrites, makes a decision, and it goes […].

The Paypers

SEPTEMBER 30, 2022

HSBC and Oracle NetSuite have unveiled a solution that embeds banking services into a cloud enterprise resource planning (ERP) system.

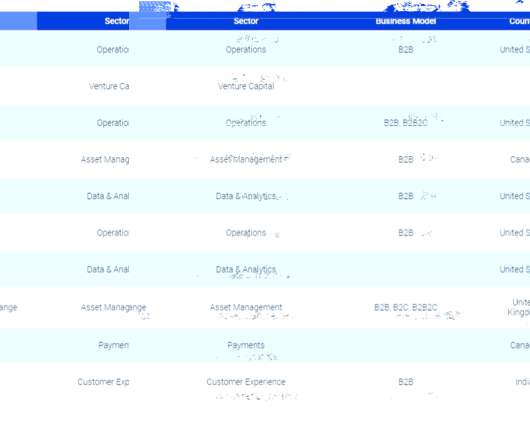

BankInovation

SEPTEMBER 30, 2022

Investments in fintechs dropped in the first half of 2022 compared with high funding volume in 2021 as interest rates continue to rise. However, investors are setting their sights on financial technology firms that have strong proven business models. Fintech startups raised $50.7 billion in the first half of 2022, down 23% year over year, […].

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

FICO

SEPTEMBER 30, 2022

Home. Blog. FICO. Meet Our 2023 FICO Decisions Awards Judges. Panel of 8 global experts to review outstanding results with AI, machine learning and digital transformation. Saxon Shirley. Thu, 05/12/2022 - 10:29. by Nikhil Behl. expand_less Back To Top. Thu, 09/29/2022 - 15:15. FICO has announced its panel of independent judges for the 2023 FICO® Decisions Awards , which honor businesses achieving outstanding results using analytics and decision management technology to grow their business, mana

The Paypers

SEPTEMBER 30, 2022

Spain-based BNPL fintech SeQura has gained up to EUR 150 million in financing from Citi in order to support its international expansion.

American Banker

SEPTEMBER 30, 2022

The Paypers

SEPTEMBER 30, 2022

UK-based secure payments provider PCI Pal has announced that its solution, PCI Pal Digital, has been chosen by Virgin Atlantic to secure its international omnichannel strategy.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

The Paypers

SEPTEMBER 30, 2022

UK-based fraud prevention company Ondato has announced that they are now accepting various types of cryptocurrency as payment for their services facilitated through CoinGate.

American Banker

SEPTEMBER 30, 2022

The Paypers

SEPTEMBER 30, 2022

Answer Pay , a UK-based Payments-as-a-Service platform, has partnered with Partner Hub , an online invoice service, to help banks offer e-invoicing services.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Let's personalize your content