Forecasting Cost of Funds Given Fed Moves

South State Correspondent

APRIL 30, 2022

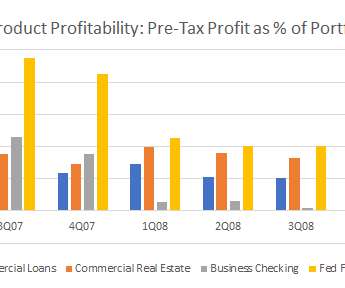

Based on the futures market, the Federal Reserve is expected to raise the Fed Funds rate to 3.00% at its December 2022 meeting. The Fed will also aggressively shrink its balance sheet to tame unwanted inflation. These two Fed moves, along with the economic environment and customer behavior will impact your forecasting of your cost of funds. In this article, we analyze the industry’s cost of funding earning assets (COF) and track how community banks’ COF behaves relative to larger banks.

Let's personalize your content