Reltime offers a decentralised Web3 merchant payment solution

The Paypers

FEBRUARY 21, 2023

Norway-based Reltime has launched a decentralised Web3 merchant payment solution in order to facilitate a direct ecommerce system.

The Paypers

FEBRUARY 21, 2023

Norway-based Reltime has launched a decentralised Web3 merchant payment solution in order to facilitate a direct ecommerce system.

Payments Dive

FEBRUARY 21, 2023

The newly published code will be part of Discover’s policy and product update for merchants and payment partners in April, a spokesperson told Reuters.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

ATM Marketplace

FEBRUARY 21, 2023

All ATMs need servicing and cash replenishment. But how can banks accomplish these tasks while also reducing risk of robbery? With ATM attacks on the rise, the risks have never been greater, especially for service workers. How can banks keep service workers safe?

Payments Dive

FEBRUARY 21, 2023

The Consumer Financial Protection Bureau has threatened action over card issuers not reporting full consumer payment data for tracking credit histories.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

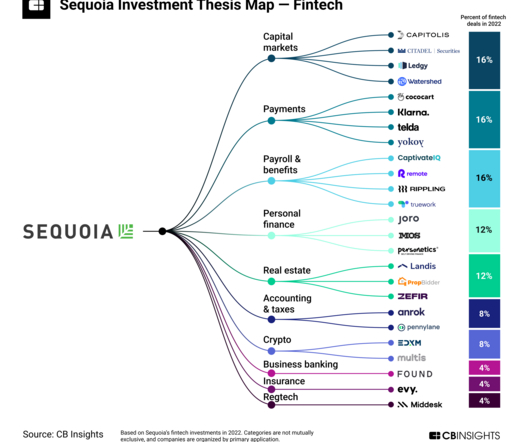

CB Insights

FEBRUARY 21, 2023

Sequoia Capital is one of the world’s oldest and most accomplished venture capital firms, with its long list of early tech investments-turned-home runs including Airbnb, Apple, Instagram, Square, and WhatsApp. While 2022 was a down year for venture capital at large, Sequoia remained active with over 100 investments. Fintech was Sequoia Capital’s top investment category in 2022, representing nearly a quarter of the firm’s deals. dive deeper into Sequoia’s top 3 fintech Targets Download thi

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

TheGuardian

FEBRUARY 21, 2023

Rises in interest rates are driving unemployment, low wages and poverty while the banks make record profits and hand out huge bonuses Another week, another corporate monopoly recording huge profits off the backs of millions struggling to pay bills, feed their families and keep the lights on. This time it’s the turn of the big banks, which are reporting record profits driven by the interest rate hikes that the Bank of England has continued to ratchet up, despite its own admission that this may do

CFPB Monitor

FEBRUARY 21, 2023

A new report from the Urban Institute examining the 2015 expansion of the Military Lending Act (“MLA”) concludes that it did not lead to better credit and debt outcomes for servicemembers and may instead have limited access to credit for some servicemembers with deep prime credit scores. The report, titled “ The Effects of APR Caps and Consumer Protections on Revolving Loans: Evidence from the 2015 Military Lending Act Expansion, ” used credit bureau data to assess the impact of the MLA’s expan

The Paypers

FEBRUARY 21, 2023

France-based ecommerce solution WiziShop has rolled out Evolup, a new service that combines affiliate marketing and artificial intelligence to facilitate the creation of online stores.

CFPB Monitor

FEBRUARY 21, 2023

The order list issued this morning by the U.S. Supreme Court did not include a ruling on the certiorari petition filed by the CFPB seeking review of the Fifth Circuit panel decision in Community Financial Services Association of America Ltd. v. CFPB. In that decision, the Fifth Circuit panel held the CFPB’s funding mechanism violates the Appropriations Clause of the U.S.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

The Paypers

FEBRUARY 21, 2023

UK-based global fintech Unlimint has expanded its alternative payment methods portfolio with the addition of Brazil-based online payment solution, Mercado Pago.

CFPB Monitor

FEBRUARY 21, 2023

A judge in the U.S. District Court for the Central District of California recently ordered Defendants in CashCall, Inc. (which included Cash Call Inc.’s CEO Paul Reddman) to pay $134 million in restitution and $33 million in civil penalties. The decision comes after the Ninth Circuit affirmed the District Court’s 2016 award of summary judgment to the CFPB , finding Defendants had violated the CFPA. .

The Paypers

FEBRUARY 21, 2023

Open Banking Limited has announced that the number of consumers and SMEs actively using Open Banking powered services in the UK has reached 7 million.

PopularBank

FEBRUARY 21, 2023

The branch will increase community lending and financial education initiatives to foster economic empowerment and financial inclusion. Popular Bank announced the Banking Development District (BDD) designation from the New York State Department of Financial Services (DFS) for the bank’s Brooklyn Fifth Avenue Branch located in Sunset Park at 4502 Fifth Avenue, Brooklyn, NY 11220.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

The Paypers

FEBRUARY 21, 2023

Deutsche Bank and Singapore-based Memento Blockchain have announced the completion of the Project DAMA proof of concept.

BankInovation

FEBRUARY 21, 2023

Bank of America was granted a record 608 patents last year by the U.S. Patent and Trademark Office, a 19% rise year over year. Key automation technologies such as AI and machine learning (ML) applications were at the fore, alongside information security and payment end uses, emanating from a diverse global workforce.

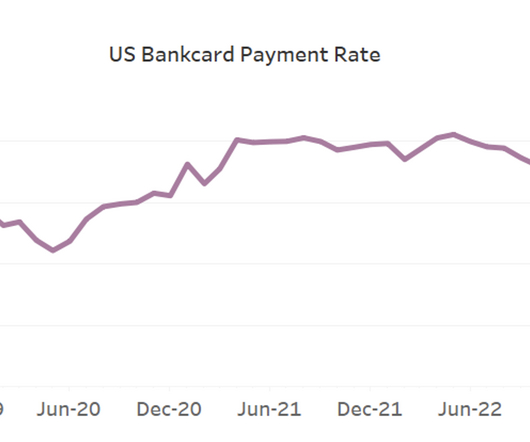

FICO

FEBRUARY 21, 2023

Home Blog FICO Canada Bankcard Industry Benchmarking Trends: Q4 2022 Update Ready for a recession? An insider look at bankcard and consumer trends in Canada FICO Admin Tue, 07/02/2019 - 05:19 by Amir Sikander expand_less Back To Top Tue, 02/21/2023 - 16:00 Recession talks have increased over the last few months. Canadian consumers are being hit with the rising cost of goods and borrowing.

BankInovation

FEBRUARY 21, 2023

Washington Federal Bank has spun off a digital innovation provider, Archway Software, led by WaFd Chief Technology Officer Dustin Hubbard, who will speak at the Bank Automation Summit U.S. 2023 in Charlotte, N.C., next week. As part of the panel, “Automation Operations: Use Cases for Transformation” on Thursday, March 2, at 1:30 p.m.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

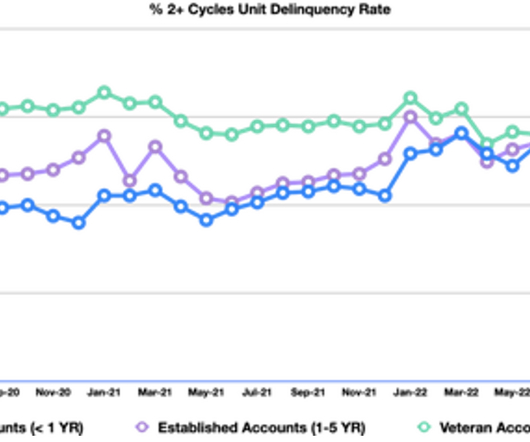

FICO

FEBRUARY 21, 2023

Home Blog FICO US Bankcards Industry Benchmarking Trends: 2022 Q4 Update Bankcard delinquencies continue to rise, higher losses are coming in 2023 FICO Admin Tue, 07/02/2019 - 04:56 by Leanne Marshall expand_less Back To Top Tue, 02/21/2023 - 16:00 FICO releases quarterly US Bankcard Industry Benchmarking trends, to catch up on the last quarter click here.

TheGuardian

FEBRUARY 21, 2023

Bank increases CEO’s bonus and plans bigger shareholder payout as it faces pressure from investor Ping An HSBC has increased bonus payouts for its chief executive after fourth-quarter profits more than doubled on the back of a jump in mortgage and loan costs for its borrowers. The London-headquartered lender said it had increased Noel Quinn’s bonus by 36% to nearly $2.2m (£1.8m), taking his overall pay to $5.5m for 2022.

BankInovation

FEBRUARY 21, 2023

HSBC’s cost-reduction efforts have allowed the bank to up tech spend to improve workflow efficiency and customer experience.

TheGuardian

FEBRUARY 21, 2023

She was woken up by an Apple Pay alert to discover the money had disappeared My daughter has started a degree course and arranged to transfer her Santander account to a new student account with HSBC. One night she was woken up by mobile phone alerts from Apple Pay, informing her that payments from her Santander account had been stopped. She discovered that the £2,449 balance had been transferred to an unspecified place.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

The Paypers

FEBRUARY 21, 2023

Digital payments solution Obopay has partnered Mastercard to launch a prepaid card and boost financial inclusion for smallholder farmers and rural communities in India.

The Banker

FEBRUARY 21, 2023

The National Bank of Georgia’s outgoing governor talks to Anita Hawser about his biggest regret and the need for central banks to make unpopular decisions.

The Paypers

FEBRUARY 21, 2023

Sweden-based digital A2A transaction platform Trustly has announced its partnership with booking platform Bokadirekt for instant payments.

CB Insights

FEBRUARY 21, 2023

Is Generative AI just a fad? Our panel of experts will debate and share their use cases across every industry, as well as what needs to happen in 2023.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Let's personalize your content