The Need for Speed: A Product Approach for Mobile Apps

Perficient

JANUARY 11, 2021

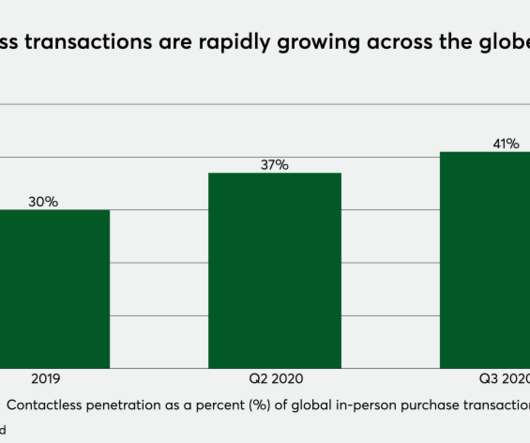

A global pandemic requires a quick response and accelerates digital transformation. The brands that can operate with speed and agility win in this environment. As consumers rely on their mobile devices now more than ever, mobile device and mobile app usage is surging. . eMarketer predict ed US adults spent over three and a half hours per day on mobile apps this year and expect this number to rise in 2021. .

Let's personalize your content