The Rise in Consumers’ Digital Engagement: A Blessing or a Curse for UK Banks?

Accenture

MAY 5, 2021

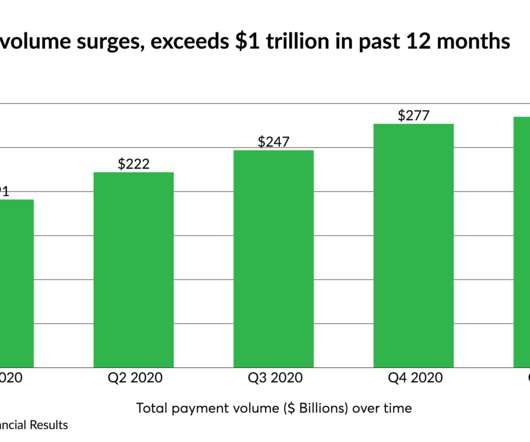

One of the clearest impacts of the pandemic has been to accelerate consumers’ long-running migration to mobile and online channels, for financial services among others. For banks and insurers, the results include greater opportunities to serve more customers in new and more efficient ways.

Let's personalize your content